Posted on Friday, 8th December 2023 by Dennis Damp

Print This Post

Print This Post

I started purchasing Treasury Bills in early 2022 to increase our returns due to the extremely low interest rates banks, credit unions, and CDs were offering at the time. The Federal Reserve kept interest rates artificially low far too long.

After a decade of near zero interest rates, those on fixed incomes were losing money hand over fist as they watched their savings evaporate year after year.

Fixed income investments offer decent yields today that are (FDIC) or (NCAU) insured or purchased direct from the U.S. Treasury. They remain in favor due to the uncertainty in the equity markets and inflation is still well above the Federal Reserve’s target rate.

Treasury Bill Rates Continue to Outperform

My article titled “Ditch your Bank’s Low Savings Rates” describes the advantages of Treasury bills compared to bank and credit union rates. I wrote the first article on this subject in March of 2022 when my bank’s savings rate was .04%.

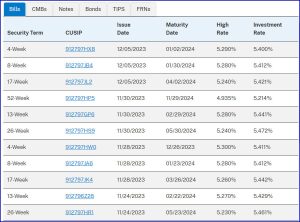

You can currently earn over 5% on all T-Bills. My last reinvestment for 13-week T-Bills yielded 5.488% on 11/2/23 and my 8-week Bills reinvested at 5.412% on 11/21/23.

If you invested $50,000 in a 13-week T-Bill issued on 11/2/2023 that is earning 5.488%, the Treasury withdrew $49,319 from your account. On the maturity date of 2/1/2024 they will deposit $50,000 into your account resulting in a $681 profit.

Had you had this amount deposited in a bank savings account paying 1%, you would have earned $124.99.

The Federal Reserve hasn’t increased rates for several months now and inflation may be here for longer than expected. Rates have leveled off somewhat, and it may be the time to move some of your cash to longer term CDs or consider investing in 52-week T-Bills, or Treasury Notes that are issued in 2,3,5,7 and 10-year durations to lock in higher yields.

Treasury Bill Investment Rates

Savings Deposits and CDs

According to the Federal Deposit Insurance Corporation (FDIC), the national average savings account rate is still only 0.45% as of October 2023.

Many online banks, credit unions, and regional banks are offering competitive rates for savings accounts and CDs from 3.5 to 5 percent and higher in many cases. Most higher rate CDs in my area are for terms from 6 to 15 months. A good deal compared to just a year ago when most rates were less than 1 percent and they are FDIC or NCAU insured.

Recently, after discussing our bank’s low money market rates with an account representative, they increased our money market rate to 3.5% for the next 13 months. Still well below what Treasures and CDs are offering. Yet, an incentive to keep more funds in our local account for unexpected expenses.

I was able to lock in 15-month CDs at two local credit unions for 5.75%. Clearview CU offered this rate through November 4th for new money and my primary credit union matched their offer!

The 30-year average gain of the S&P 500 is 7.1% after inflation. These CDs have no market risk if you stay under their insured limits. It was a no brainer to move some of the funds I was cycling through the Treasury to this attractive yielding investment.

Yes, rates can continue to rise, or if inflation is truly tamed as the administration predicts, they may languish at the current levels for some time before the Treasury changes course and begins lowering rates.

I-Savings Bond Rates

I Bonds issued November 1, 2023, to April 30, 2024, earn 5.27%. This includes a 1.3% fixed rate. Still a great rate for one of the safest investments available. You can’t cash them in for one year. Plus, if you redeem them within the first five years you lose three months’ interest. Savings bonds are easy to purchase and are maintained in an online account with Treasury Direct.

I-bonds issued in 1999 have a 3% fixed rate, they are earning just under 7% now, the 3 percent fixed rate and the 3.97% inflation rate for the new issue I-bonds.

If you purchase an I-Bond by no later than April 31, 2024, you’ll receive the 5.27% for six months from the date of purchase. The rate will change after that to the new inflation rate announced this coming May plus any fixed rate your previously purchased bonds may have.

Summary

Now that CD rates are improving; if you can lock up your discretionary savings for 6 to 15 months or longer, they are a viable option. CDs can be cashed in before maturity, however the penalties can be significant. Treasury Bill rates are moderating down a bit, not much but you can see the trend on the above chart. Brokerage firms like Fidelity and Vanguard also offer access to national FDIC insured CDs at reasonable yields.

If you are unfamiliar with purchasing fixed income assets through your broker, their fixed income department will walk you through the process. They are very helpful.

Short term T-Bills provide impressive yields considering how many banks continue to low ball their savings rates for established accounts. These banks are betting on the reluctance of many to move their savings and checking accounts elsewhere.

Print out your T-Bill transactions and retain a hard copy for your records. I print the screen for each new purchase and reinvestment.

If you are reluctant to move your savings to Treasury Bills, CDs, or higher paying accounts elsewhere, there are still options for you to earn higher rates.

Schedule an appointment with a representative from your bank or credit union and negotiate a higher rate for your savings and money market accounts like my wife and I did last month. It pays to speak up and insist on a fair rate of return for your hard-earned money.

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- Annuity Expectations – Before and After

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

- UPDATE - Deferred Resignations and VERAs Return - April 11th, 2025

Tags: CDs, Certificate of Deposits, I Bonds, Savings Bonds, T-Bills, Treasury Bills

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post