Posted on Saturday, 14th January 2023 by Dennis Damp

Print This Post

Print This Post

The December 2022 Consumer Price Index (CPI) dropped .1%, the first drop in the CPI since December of 2020. A sign that inflation may be improving slightly. However, year over year inflation was 6.5%, still high by any standard. Wages, consumer goods, food, and housing remain high.

The Federal Reserve is expected to continue increasing rates this year in an attempt to achieve their 2 percent target core inflation rate. Many feel this target is unrealistic and it may end up much higher. There is still considerable uncertainty in the markets today.

Rates Are Rising

Finally, CD rates are rising enough to compete with Treasury Bills, they aren’t quite high enough to beat I-Bonds yet. Treasury Bills continue to offer a safe haven for our cash with decent yields. There are still challenging times ahead for investors with the country bordering on a recession and market volatility continues to be disconcerting for most.

There are other ways to economize and save for those planning their retirement and retirees alike.

CDs Are Catching Up

Locally, many credit unions and regional banks are offering between 4 to 5 percent for 9 month to 2 year CDs enticing account holders back to the fold. Not bad, considering only a short time ago they were offering less than 1%! I’m staying with 8-week T- Bill ladders for now; they are yielding 4.523% presently. You can have the Treasury reinvest them for you for up to two years. I believe the Federal Reserve will continue to raise rates to tamp down inflation for some time yet.

When rates start to level off, it may be the time to move to longer term CDs or consider investing in 26 or 52-week T-Bills, or Treasury Notes that are issued in 2,3,5,7 and 10-year durations to lock in attractive yields.

I-Savings Bond Rates

Now is the time to pick up more I-Bonds, you can purchase $10,000 in I-Bonds through Treasury Direct each year. If married, both can purchase up to that limit. Plus, you can buy up to $5,000 in paper I-Bonds with your tax return. I intentionally overpaid my quarterly estimated federal taxes the year before and was able to buy paper I-Bonds with my return. I’m not sure yet if I overpaid enough this year to purchase more.

The current I-Bond composite rate is 6.89%, still well above what you can get elsewhere. This new rate runs through April 30, 2023. As I mentioned in an earlier article on this subject, you can’t cash them in for one year. Plus, if cashed in within the first five years you will lose 3 months interest.

My I-bonds issued in 1999 have a 3% fixed rate, these are earning 9.4% now! They earned over 13% from May 1 to October 31 of last year! Can’t beat that.

If you purchased an I-Bond by no later than April 30th of this year, you’ll receive the 6.48% for six months from the date of purchase, the rate will change after that to the new rate announced this coming May for the next six-month period.

Treasury Bill Rates Continue to Rise

My article titled “Ditch your Bank’s Low Savings Rates” describes the advantages of Treasury bills compared to bank and credit union rates. I wrote the first article on this subject last March when my bank’s savings rate was .04%; it is currently 1%, still well worth moving the majority of my savings to T-Bills.

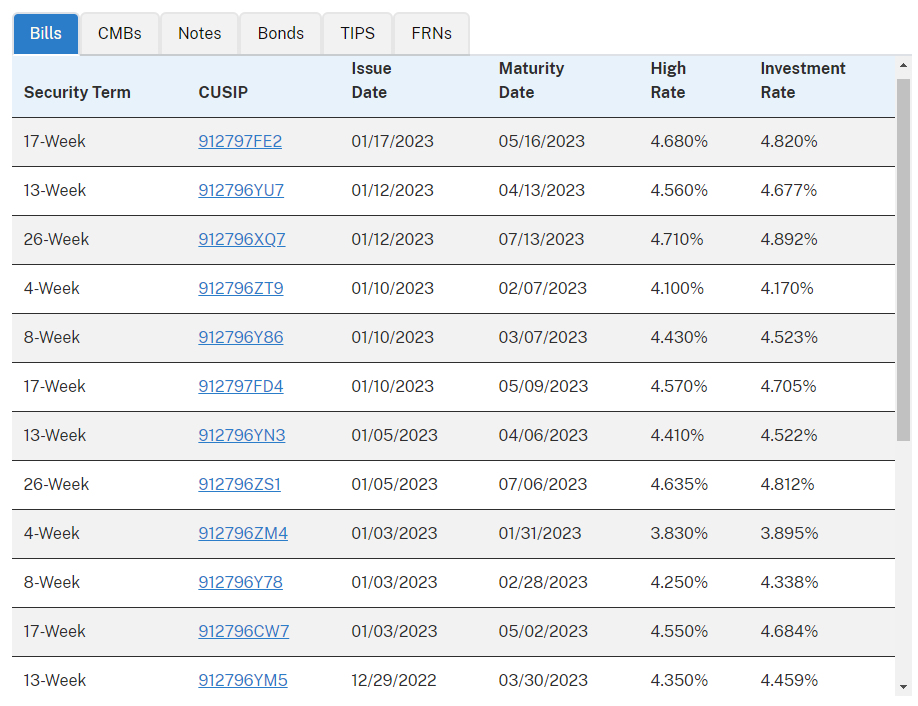

Today you can earn around 5% on a 52-week T-Bill, the shorter-term 8-week Bills, as noted in the following chart, are earning 4.523%!

If you purchased $50,000 in the 26-week T-Bill issued on 1/5/2023 that’s earning 4.892%, the Treasury withdrew $48,7777 from your account. On the maturity date of 7/6/2023 they will deposit $50,000 back into your account for a $1,223 gain.

Had you had this amount deposited in a bank money market account paying 1%, like mine, you would have earned only $250!

Summary

With the new year beginning, it’s an ideal time to pick up more I-Bonds if you have the cash to do so. They grow tax deferred over time and I’ve held I-Bonds since they initially offered them in 1998.

Now that CD rates are improving, and if you can lock up your discretionary savings for 9 months to 2 years or longer, they are an option to consider. You can cash CDs in before maturity, however the penalties can be significant. I’m waiting until rates level off and maintaining my 8-week T-Bill ladders until that time.

The U.S Treasury updated their website and it is now more reliable. However, contacting them by phone is tedious with very long wait times. Plus, they aren’t accepting email questions now either unless you have an open ticket with them.

Print out your T-Bill transactions and retain a hard copy for your records. I print the screen for each new purchase and reinvestment.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Which Way is Up – A Retiree’s Conundrum

- Is the Stock Market Keeping You Up at Night?

- TSP Guide

- TSP Considerations

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post