Posted on Friday, 24th March 2023 by Kevin Moss

Print This Post

Print This Post

It’s a little early to start talking about health care open season. However, major Medicare Part D reforms were enacted in the Inflation Reduction Act of 2022 (IRA) that everyone needs to be aware of. Some of the legislation’s provisions seek to lower prescription drug costs for both Medicare beneficiaries and the federal government.

Historically, federal annuitants found little value in joining a Part D plan because FEHB plans’ prescription drug coverage was as good or better. However, certain new reforms strengthen the value of Part D and should be considered in your plan choice next year and even more in future years.

2023 and 2024 Changes

Medicare Insulin Prices Capped

Insulin covered by Part D plans is capped at no more than $35/month starting this year. Part D plans will not have to cover all insulin products but will have to offer one of each dosage form— vial, pen—and insulin type—rapid-acting, short-acting, intermediate-acting, and long-acting.

Catastrophic Coverage Coinsurance Dropped

Once total spending between the Part D enrollee, Part D plan, and drug manufacturers reaches $7,400 in a year, catastrophic coverage begins. Currently, the enrollee pays 5% of expenses in the catastrophic coverage phase. Beginning in 2024, Part D plans will eliminate the 5% enrollee share.

Part D Premium Increase Limits

Starting in 2024 and lasting through 2030, the IRA limits Part D premium growth to no more than 6% per year. Part D premiums increased 10% on average from 2022 to 2023, so the 6% cap offers some protection from large price hikes in the future.

2025 Change

Out-of-Pocket Spending Cap

In 2025, there will be a new $2,000 enrollee out-of-pocket spending cap in Medicare Part D plans. Additionally, enrollees will have the ability to spread out that $2,000 over the course of a year. This provision will limit out-of-pocket drug costs to no more than $167 a month for any Part D enrollee.

This Part D change will produce substantial savings for annuitants with high out-of-pocket drug costs. For those needing expensive brand or specialty drugs to treat cancer, multiple sclerosis, or other medical conditions, joining a Part D plan will be a huge cost saver unless FEHB plans modify their offerings to match this benefit.

Why such big savings? Because the soon-to-be $2,000 out-of-pocket maximum in Part D is significantly lower than almost all catastrophic limits seen in FEHB plans, which range from as low as $1,500 to as high as $9,100 when using in-network providers for self-only enrollment.

Two Part D Enrollment Options

OPM in their annual carrier call letter has indicated their desire to have federal annuitants receive improved Part D benefits and is allowing FEHB carriers to offer two Part D enrollment options—FEHB Medicare Advantage (MA) and FEHB Prescription Drug Plans (PDP).

FEHB MA Plans

FEHB MA plans are more generous than regulatory MA plans and are only open to federal annuitants. They have only recently been made available through FEHB.

FEHB MA plans bundle a Medicare Part D plan for prescription drug coverage. By joining an FEHB MA plan, you’ll receive improved Part D benefits going forward. Moreover, because Medicare is the primary payer for annuitant medical bills, these plans pass on most of their FEHB enrollee cost to Medicare and offer low FEHB premiums, rebates on the Medicare Part B premium, or both.

There are several nationwide FEHB MA plans available—Aetna Advantage, APWU High, Compass Rose, Foreign Service, MHBP Standard, NALC High, Rural Carrier, and SAMBA. There are also local FEHB MA plans available from Humana, Kaiser, UnitedHealthcare, and UPMC that between them cover most states. Expect to see even more FEHB MA plans in 2024.

To join one of these FEHB MA plans, you must be enrolled in both an FEHB plan and Medicare Parts A and B. All FEHB MA plans either reimburse or reduce some or all the Part B premium. Many have $0 out-of-pockets costs for medical and hospital expenses from providers that accept Medicare, except for prescription drugs.

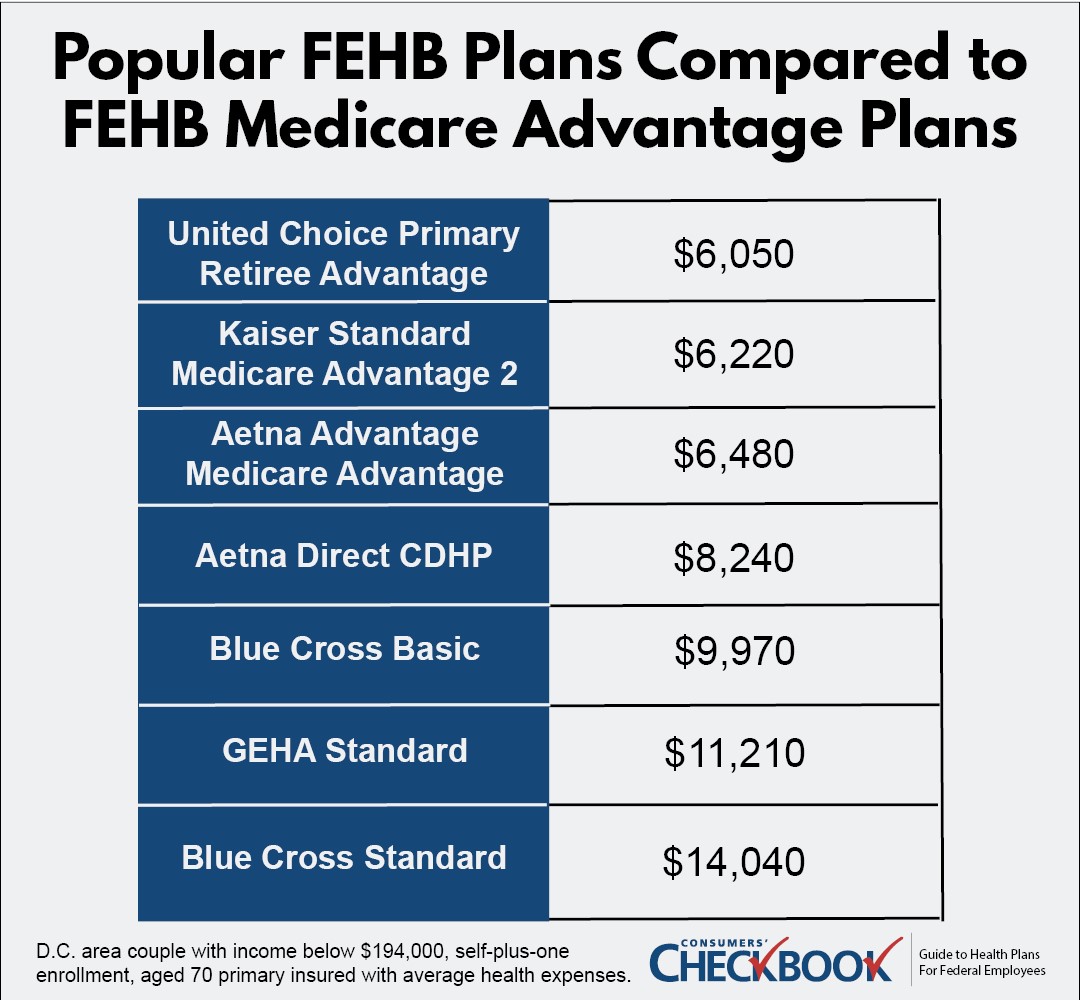

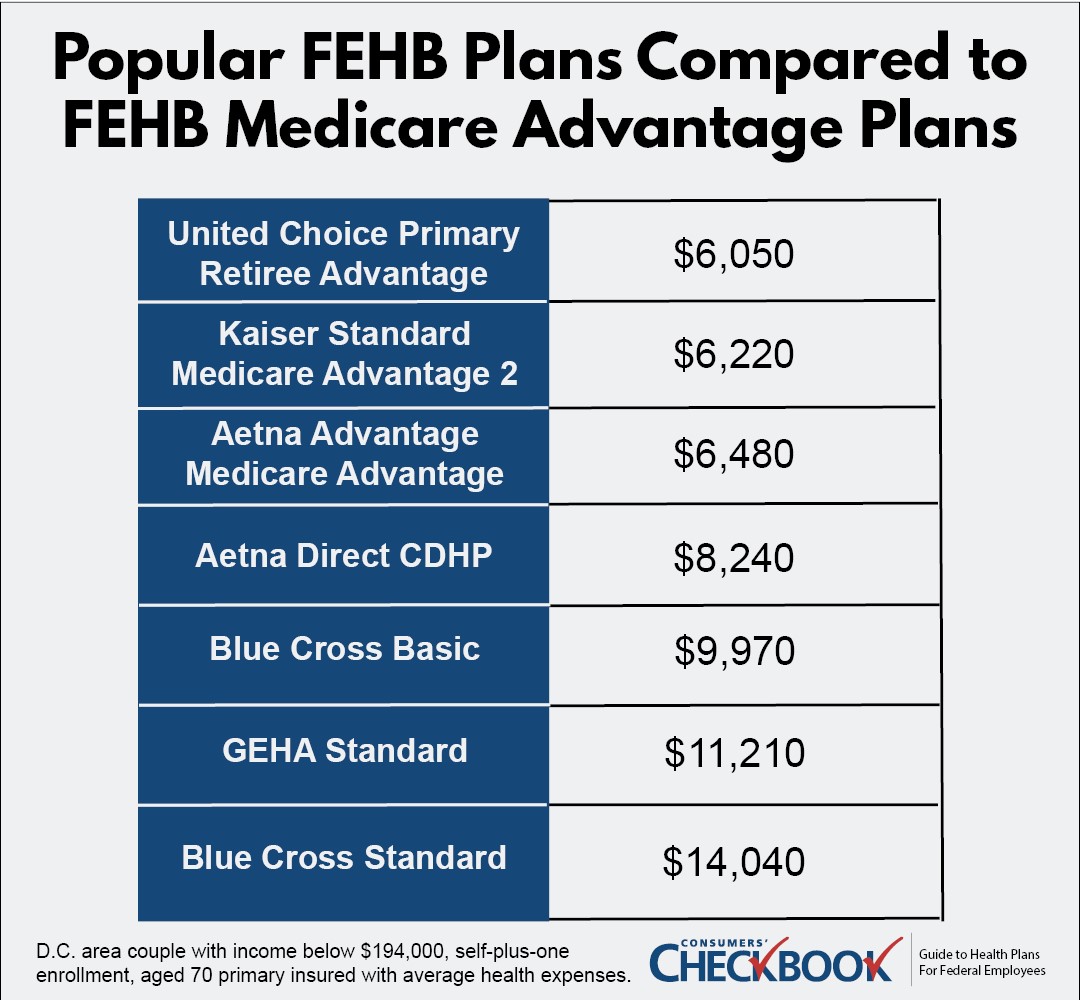

For most annuitants, the FEHB MA plans will be the least expensive plan choice considering premium savings as well as $0 out-of-pocket medical and hospital spending. Checkbook’s Guide to Health Plans ranks all FEHB plans based on a total cost estimate that’s a combination of for-sure expense (premium) plus likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

For 2023 coverage, we calculate that a D.C.-area couple enrolled in Medicare Parts A and B with income below $194,000 could have saved $7,990 in estimated total costs this year by switching from BCBS Standard to United Choice Primary Retiree Advantage—a cost savings likely to remain the same in future years assuming no major plan changes.

While most annuitants would benefit financially from enrolling in an FEHB MA plan, it may not be the best choice for everyone.

If you fall into one of the high-income categories—more than $97,000 for individuals or $194,000 for couples—Part B is of limited financial value due to the higher premium. With FEHB MA plans, you’ll get hit twice with Income Related Monthly Adjustment Amounts (IRMAA), which means you’ll be paying both a higher Part B and Part D premium.

Additionally, if you spend a large portion of time abroad, only one FEHB MA carrier (UnitedHealthcare) provides reimbursement for routine overseas care. Of course, since you stay enrolled in an FEHB plan with any FEHB MA plan, you’ll always have the emergency overseas care coverage that every FEHB plan provides.

Finally, make sure to check the FEHB MA plan provider directory before enrolling. While the plans claim you can see any provider that accepts Medicare, there are a handful of examples where certain networks are excluded from coverage.

FEHB PDP Plans

Beginning next year, OPM will allow FEHB carriers to offer supplemental prescription drug Part D plans along with their FEHB plan offerings. To receive OPM approval, the FEHB PDP coverage must be as good or better than the prescription drug coverage offered from just the regular FEHB plan. This means, like FEHB MA plans, there will be no extra premium to join an FEHB PDP.

There is also a provision to allow FEHB carriers the ability to auto-enroll their Medicare plan members into an FEHB PDP. However, plan members will be able to opt-out if they wish, and FEHB carriers will have to show how they’ll inform their members, process enrollments, and provide customer service before OPM approves auto-enrollment.

Even though annuitants won’t be subject to an extra premium with an FEHB PDP, IRMAA still applies if you have a high income. For 2023, Part D IRMAA was an extra $12.20/month in the first income tier and up to an extra $76.40/month in the fifth income tier.

Annuitants will need to pay close attention to OPM announcements and communication from their existing FEHB plan this fall, before and during Open Season. You could be auto-enrolled in a new FEHB PDP or, if not auto-enrolled, you might consider enrolling in the FEHB PDP.

While the FEHB PDP drug coverage is supposed to be as good or better, you’ll need to carefully review plan materials to confirm that the cost sharing arrangements are the same, or lower, in-network pharmacies remain the same, and that any existing prescription drugs you take are still on the plan formulary.

2024 FEHB Open Season Advice

This year review the 2024 FEHB plan brochures, that will be coming out this fall, carefully to best understand the impact these changes will make to your prescription drug coverage.

Federal annuitants, and soon to be annuitants, have even more healthcare decisions to consider: The choice of whether to enroll in Part B at age 65 (which opens the door to FEHB Medicare Advantage plans), which FEHB plan to select during Open Season, and now whether to enroll in Part D either through an FEHB MA plan or FEHB PDP.

The right choice for you will largely be determined by your anticipated prescription drug usage and whether you are subject to higher Part B and Part D premiums through IRMAA.

If you have low usage and aren’t auto-enrolled in an FEHB PDP, you can delay Part D enrollment. There is no late enrollment penalty since your FEHB plan drug coverage is considered creditable coverage by OPM. If your situation changes in the future, you can enroll in Part D then.

For annuitants with moderate or high prescription drug usage, including annuitants that take insulin, joining Part D can be an important way for you to save on your out-of-pocket drug expenses.

For annuitants that aren’t subject to IRMAA, FEHB MA plans will be the best way to receive enhanced Part D benefits and save a considerable amount of money on total health care expenses. Annuitants subject to IRMAA will need to decide if enhanced Part D benefits are worth paying the extra IRMAA amount.

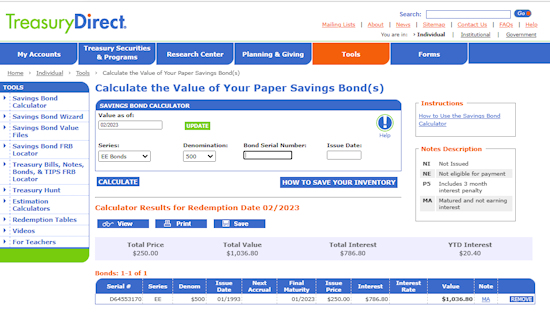

Helpful Retirement Planning Tools

Author Bio

Kevin Moss is a senior editor with Consumers’ Checkbook and a contributing writer for www.fedretire.net. Checkbook’s Guide to Health Plans for Federal Employees is a comprehensive FEHB plan comparison tool that helps federal employees select the plan best suited to their needs.

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: MA Plans, Medicare Part D, Prescription Drug Coverage

Posted in BENEFITS / INSURANCE, RETIREMENT CONCERNS, SURVIVOR INFORMATION, WELLNESS / HEALTH

Comments (0)|  Print This Post

Print This Post

Print This Post

Print This Post

Print This Post

Print This Post