Posted on Friday, 4th March 2022 by Dennis Damp

Print This Post

Print This Post

Everyone must prepare to maintain their standard of living in retirement. Retirees from all sectors and those still working feel the wrath of this unrelenting force that constantly impacts our day to day lives. The progression of this financial endemic (inflation) is always upon us. At times, and when the economy is on a sound footing, it’s hardly noticeable; unlike today when prices are skyrocketing.

INFLATION IMPACT

INFLATION IMPACT

According to Kiplinger, “If you needed $60,000 for your first year of retirement, in 20 years you would require $108,366.67 to match today’s purchasing power of $60,000. Another way to look at it: At 3% annual inflation, that initial $60,000 would be worth only $33,220.55 in 20 years.”

The annual inflation rate increased to 7.5% in January of this year as reported by the US Bureau of Labor Statistics. This is the highest rate since 1982 and above market forecasts. Much of it is due to escalating energy costs, supply chain disruptions, labor market shortages, excessive stimulus spending, and pent-up demand as the pandemic wanes.

My natural gas bills have increased dramatically this year. The gas company’s cost per thm increased 35 percent this year! Costs are increasing across the board with few if any areas unaffected.

COST INCREASES PAST 12 MONTHS (From various sources)

- New Cars – 12% (Have Your Tried Buying a New Car Lately) – 82% of all new cars sold above MSRP in January!

- Used Cars – 40%

- Gas – 58%

- Housing

- New Homes – The median home sales price was up 19% in 2021 and is projected to increase another 14% this year according to Zillow.

- Rents – 11%

- Heating Costs

- Natural Gas – 30%

- Propane – 54%

- Heating Oil – 34%

- Meat poultry and fish – 13%

- Electricity – 7%

- Medical Care

- General – 8.4%

- Medicare Premiums (The standard Part B monthly premium amount in 2022 is $170.10, a 14.5% increase from last year.)

- FEHB Average Increase for 2022 – 2.4%

COST OF LIVING ADJUSTMENTS (COLAs)

Do COLAs compensate for these increased costs? Emphatically, NO.

Federal employee’s annuities increase most years with a Cost-of-Living-Adjustment (COLA), the same adjustment Social Security recipients receive. However, the Senior Citizen’s League reported that Social Security benefits have lost 30 percent of their buying power since 2000!

Even though CSRS annuitants received a 5.9% COLA increase for 2022 (FERS annuitants 4.9%) our costs are increasing at an alarming rate; each month our purchasing power diminishes.

RETIREE’S DILEMA

Retirees suffer disproportionately; in order to finance the national-debt the federal reserve keeps interest rates artificially low so that savings accounts and CDs receive a net negative return due to the inflation effect. Retirees can’t risk losing their savings and often keep their cash in local bank accounts and CDs that earn almost nothing. Our bank savings account has a .05 percent yield! Yet, we all have savings accounts at these alarming low rates out of necessity.

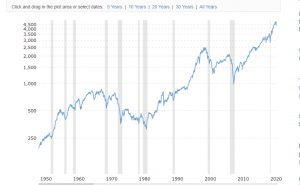

Many retirees can’t risk investing in the stock market. A major market correction or recession could shrink their investments by up to 50 percent or more and take years to recover in some cases.

Initially the administration and the Federal Reserve announced that inflation was transitory. They changed their position as the economy overheated and costs continue to rise. The excessive stimulus spending which amplified the supply chain problems, along with many other factors has spurred demand for everything.

I’ve lived long enough to experience wild inflation and Interest rate cycles. The gas shortages of the 1970s and when interest rates reached 16.63% in 1981, the highest point in modern history. My wife and I relocated and purchased a home in 1985; we paid 11.5% interest on a 30-year loan! The couple that sold us the home laughed at the closing because the $75,000 4-bedroom three bath home would cost us over $250,000 if we didn’t refinance down the road, which we did several times before paying it off.

I helped my wife’s elderly aunt move her bank savings account in 1983, earning 5%, to CDs at the same institution yielding 13%! She couldn’t believe her good fortune.

With this country’s huge debt crisis and the Fed’s ever expanding balance sheet to astronomical levels, inflation is inevitable; we are feeling the aftereffects of their over indulgence. Yet, I have faith in the America we grew up in and the system of government our founding fathers created all those many years ago. The checks and balances that take affect when the pendulum swings too far in one direction, and when the people redirect our path at the ballot box. No system of government is better than ours and we proved this many times when circumstances were dire and the outlook bleak.

KEEPING AHEAD OF INFLATION

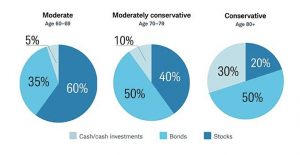

It’s difficult keeping up with inflation with the increases noted on the above chart. To survive unscathed, we must locate lower cost alternatives and stable recession resistant investments with lower management fees, hold off on large purchases until hopefully things calm down, possibly work part-time in retirement, and so much more.

There are ways to mitigate inflation’s impact. For those invested in the Thrift Savings Plan (TSP), they have some of the lowest management fees available and will soon offer a Mutual Fund Window allowing you to invest in 5000 private sector mutual funds. The TSP funds charge very low management fees from .043% to .059% depending on the fund.

The L Income Fund is designed to minimize the impact of inflation for retirees that can’t afford to lose their savings and invests in the following funds:

- G Fund – 70.76% (Guaranteed to never decrease in value)

- F Fund – 5.74% (Corporate bond fund)

- C Fund – 12.33% (S&P 500 index fund)

- S Fund – 2.95% (Small cap index fund)

- I Fund – 8.23% (International stock index fund)

The advantage of the L Income Fund is that 76.5% is invested in bonds, the majority of which are special issue federal bonds that will never decease in value. The remaining 23.5% is invested in a cross section of the market that will grow over time. Last year the L Income fund yielded 4.18% and the ten-year-average return is 4.33%.

The G Fund is another option for those who want a bulletproof investment that won’t decrease in value and will earn considerably more than most bank savings accounts. However, it won’t keep up with inflation. The 2021 yield was 1.45% with a 10-year average yield of 1.93%. Still, far greater than my local bank’s .05% yield!

Find alternative higher yielding safe investments such as I Savings Bonds, now yielding 7.12%. Unfortunately, the Treasury Inflation Protected Securities (TIPS), that you can purchase direct from the government or through a broker, have negative rates of return. The yield on a TIPS bond is equal to the Treasury bond yield minus the expected inflation rate. Most TIPS selling today are issues with a .25% yield. As a result, when standard Treasury bonds are trading at yields below the expected inflation rate, TIPS yields fall into negative territory. This has been the case since late 2010. Why would investors purchase TIPS with a negative yield? According to Fidelity Investments, “If actual inflation exceeds the breakeven rate in the future, the adjustment to the TIPS will eventually provide a higher real return than the conventional bond. ”

There are balanced mutual funds that hold up well in downturns and recessions. Market corrections can last years and individual funds and stocks recover at different intervals. Recoveries are typically referenced to a market index like the S&P that is comprised of the top 500 American companies.

If you invested 100% of your non-TSP investments in the Vanguard Wellesley Income Fund (VWINX) before the last bear market started in 2008, your investment would have only decreased 9%. Investors recovered all of their losses in less than a year! This mutual fund has averaged 7.2% annually since its inception in 2001. The DOW & S&P indexes fell more than 50% during this period and took several years to fully recover.

I’ve written a number of articles on the subject over the years that you may find helpful:

Take precautions now to protect your assets and prepare for the rocky road ahead.

Helpful Retirement Planning Tools

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post

Print This Post

Print This Post

Print This Post

Print This Post