Posted on Saturday, 4th July 2020 by Dennis Damp

Print This Post

Print This Post

My lifestyle column focuses on issues that affect retirement and I often cover current events. The issues of the day can be and are often controversial. My last article, “Stop the Insanity, History Can’t Be Rewritten,” garnered considerable comments, some thoughtful, others quite abrasive, and most supporting the article’s theme. One individual advised me to stick with retirement issues. Certainly, the unrest today affects all retirees. Dialog is a good thing, we have different opinions driven by our life experiences, teaching, or in some cases indoctrination.

Fortunately, all Americans have the right of free speech under the First Amendment of the constitutiomn, “Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the government for a redress of grievances.”

That one article is the foundation of our republic and the reason we are who we are today; a free and prospering society. It says volumes, its simplicity is genius. Our founders laid out our Constitution to be the guiding light for our republic and they did this on only four large sheets of parchment!

We all have a voice in America and the right to express it peacefully. In this country, we have equal rights of expression and should not be governed by the mob mentality and shamed into silence by the few. The vast majority want to live in a law-abiding free society, not in anarchy that is driven by sedition. Sedition is the act of inciting revolt or violence against a lawful authority with the goal of destroying or overthrowing it. It is a serious felony punishable by fines and up to 20 years in prison.

The major news networks often distort their commentary with ideological beliefs instead of reporting the actual news. They foment violence and racial divide to accommodate their agenda and turn us against one another.

The few, in this case–the destructive mobs that are terrorizing our cities—have unfortunately gained the financial support of many including major corporations by shaming them into submission. However, to blindly support movements you know so little about is reckless. Many of these groups are Marxist and that philosophy destroys all that embrace it. Their leaders proclaim it openly and one of them recently stated on national TV, “If this country doesn’t give us what we want, then we will burn down this system and replace it.” Should we or any rational company support that, burning this country down and replacing it? Do we support the rioting, looting, and crime that results, not from legitimate protests but from anarchists that are bent on destroying the fabric of this society? The First Amendment confers the right to “peaceably assemble,” not to destroy or loot personal property!

These groups often raise the concept of white privilege to turn one against the other. I believe privilege is color blind. It is earned and anyone can achieve that status in America if they are willing to make sacrifices and work hard to achieve their goals. I’m proof of that, I was raised in abject poverty and rose above it through hard work and perseverance. Were there injustices, segregation, and exclusion prior to the civil rights movement? Certainly, and it was pervasive and some still exists to this day.

You can’t erase the past, yet I see a bright future for all Americans if we reject the mob and continue on the path our founding fathers provided. The mob only rules if the majority stays silent. This country has come a long way; it isn’t the 1850s or the 1960s. Seventeen percent of all marriages in 2017 were mixed race, in 1967 only 3 percent of marriages were interracial? Just look at our TV shows, soap operas, sports teams, movies and more. Diversity and inclusion rules. In the cities we see African American mayors, governors, and in some cases such as Atlanta I believe over half the police force is minority. More minorities were employed before the pandemic than any time in history. The graduation rate for minorities is rising and Obama was our President! Anything is possible in America and what determines our destiny is self determination, drive, and motivation.

Helpful Retirement Planning Tools

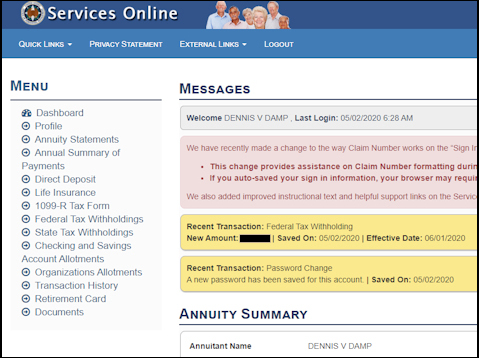

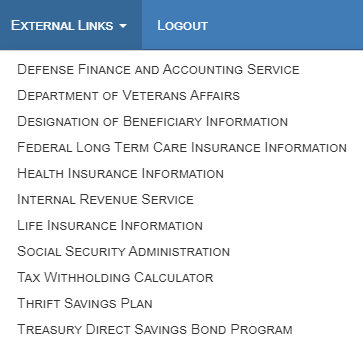

Request a Federal Retirement Report™ to review projected annuity payments, income verses expenses, FEGLI, and TSP projections.

- 2020 GS Pay Scales

- Retirement Planning For Federal Employees & Annuitant

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2020 Leave and Schedule Chart (Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Posted in LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post