Posted on Friday, 28th September 2018 by Dennis Damp

Print This Post

Print This Post

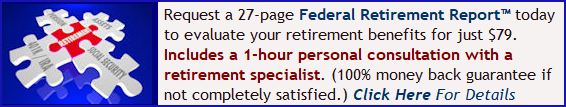

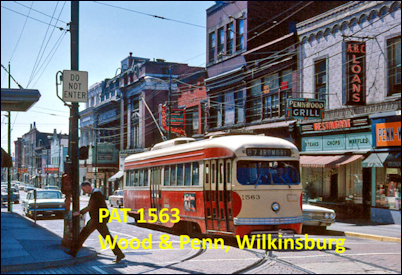

I grew up in Wilkinsburg, the Town of Churches. A bustling small town nesseled on the outskirts of Pittsburgh, PA. In my youth Wilkinsburg was a vibrant community and great place to raise children. We had a Woolworth’s and Murphy’s Five and Dime store, the Rolland Movie Theater, Faller’s Furniture, the Penn-Lincoln Hotel, John’s Laundry where my sister worked, and many restaurants including the Penn-Wood Grill, two Isaly’s Dairy Stores, and specialty shops of every kind.

The Rolland Theater is in the background & Penn-Wood Grill to the right.

(Wilkinsburg Historical Society Photo)

In my pre-teens my friends and I would forage for pop bottles to return to the grocery store; 5 cents for the quart bottles and 2 cents for a 12-ounce bottle. A quart bottle was a prized possession. The older kids threw the bottles into thorn bushes just to watch us gingerly pull them out. I earned a lot of cuts and scrapes in those days.

If I lucked out, I would find enough bottles for the 25 cents admission to Rolland Theater’s Saturday matinee, plus 10 cents for a bag of popcorn. Today, our generation, is accused of polluting the environment, yet we used paper bags at the grocery story, cotton diapers were washed daily, returned pop and milk bottles to the store for the deposit, darned socks, mended clothes, and our soft drinks, straws, and coffee cups were made with paper! We weren’t a throwaway society then; TVs, radios, and appliances were repaired, not thrown in the garbage heap. What generation is truly environmentally conscious?

My mother was an elevator operator at the Shields Building on the corner of Ross and Wood Street; yes, an elevator operator, one of many lost crafts today. The carriage had a sliding metal mesh screen and ornate brass lever that you manually operated to move up or down. You had to stop it at just the right time or you would have to step up or down to exit. My mother stopped it, without fail, at exactly the right spot each and every time. If I shut my eyes, I can see my mom at the controls, conversing with building tenants.

(Wilkinsburg Historical Society Photo 1966)

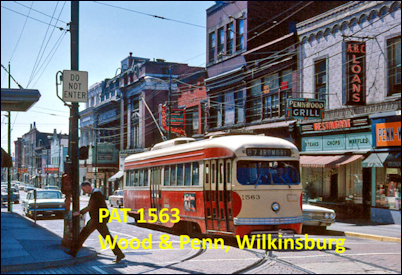

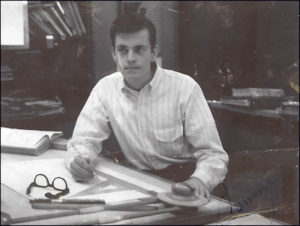

My first full time job was with R. Bruce Miller & Associates on the 4th floor of the Shields building. My mother talked Mr. Miller into interviewing me for a drafting position and I started work before I graduated. I stayed with them until I received my draft notice and joined the Airforce. I have many happy memories from those days.

First Full Time Job (Dennis V. Damp 1968)

In the 1960’s there wasn’t a vacant store front on Penn Avenue, today not only are store fronts vacant many buildings were torn down years ago. Me and my friends could walk anywhere back then, and it was a safe environment for kids and adults alike. We could ride the trolley for 10 cents or take a train to downtown Pittsburgh. I don’t recall any drive by shootings, home invasions, drug overdoses, or gang warfare back then.

Prior to touring my old high school, I drove through town and discovered the apartments where my mother and I resided were demolished along with many landmarks. The roads that I walked to school on were littered with abandoned boarded up buildings, and in some places the weeds towered over the yards extending to the street, crowding out the sidewalks. I vividly recall walking those routes every day for years.

Wilkinsburg High School (Dennis Damp 9/15/2018)

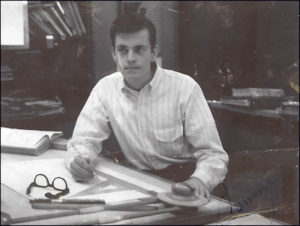

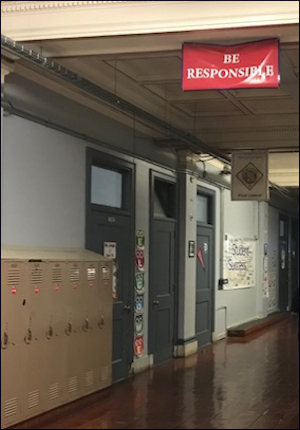

The 4-story high school was built in 1911 and the exterior is striking to say the least. The many steps made it a challenge for some to navigate, including myself. The 12-foot-high ceilings, long dark hallways, brown tile floors, and wood trim seemed surreal and in stark contrast to schools today. You could see the many building modifications made over the years to modernize, including open cable raceways hung high towards the hallway ceilings to route automation cables and power to classrooms.

Hallway With Raceway Modification (Dennis Damp 9/15/2018)

In my youth I remember walking these corridors which included the boy’s gymnasium, swimming pool, personal interactions with friends, and several exceptional teachers including Mr. Sheffler. My graduating class had over 300, while the last class to graduate numbered 25! The rumor is that the school will be torn down soon and the high school students in town are now bussed miles away to another municipality.

Glass and Tile school flooring. (Dennis Damp 9/15/2018)

(You can see through the glass from the lower floor!)

The school is a metaphor for the community. The beautifully ornate iron stair railings are painted over many times, including the wood handrails that when you grab them they grab you back! I visited one of the rest rooms and it hadn’t changed since my school days; same fixtures, stalls, etc. Everywhere you looked I saw shadows of the past. Once a proud and venerable institution now relegated to the wrecking ball.

School Stairwell (Dennis Damp 9/15/2018)

High school was full of cherished memories, good friends, and enjoyable school activities for most. My high school days were just a little different. I was there half a day, attending trade school for civil construction technology in the mornings throughout my junior and senior year. A training option they should use more of today.

I had little time to socialize or participate in school activities. Fortunately, I found a job at age 15 with Isaly’s on Penn Avenue. When I wasn’t working I was courting Mary, my wife of 49 years this November. Yet, I had friends like John, Chuck, Ernie, Clerence, Georgian, Joeanne, Judy, Barbara, and many others. I worked with Georgian’s mother at Isalys. Georgian and her sister visited the store often and we all would joke around during their visit. Life was busy but good.

You can see why people attend their high school reunions. We reestablish old friendships, share what has transpired in each other’s lives, and compare life then and now. You also learn about those who couldn’t attend, and ponder where others ended up.

Unfortunately, many small towns have suffered the same consequence. The NAFTA agreement shut down most of this country’s manufacturing, leading to abandoned buildings and blight. My mother worked at an envelope factory in town that has long since closed its doors. The workers were laid off without any golden parachutes. After that, mom went to work at the diaper laundry only to be laid off when disposable diapers became the rage. Global markets with their low wage rates put many others out of work and residents had to flee to the suburbs and other locations leaving only the shell of a city behind. Our textile mills, furniture manufacturers, steel and most others were literally sent packing.

When you buy an old house, people often say that it has good bones and has the potential to be restored to its former self. Hopefully, this will happen to our small towns. I still see potential in Wilkinsburg. There is new a housing development on South Trenton were I once lived. We rented an attic apartment on South Trenton with no central heat in the 1960s. It had a gas heater in the living room, if you could call it that. The building was demolished to make way for this development.

The Yingling Mansion (Erin McClain Studio)

The 28-room 112-year-old Yingling Mansion on Wood Street was transformed into a showplace for local designers in 2018. The Wilkinsburg Central Development Corporation has developed extensive plans to rejuvenate the town. I can only pray their plans bear fruit. It’s a daunting task and I wish the best for my home town.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Posted in LIFESTYLE / TRAVEL, Travel

Comments (0)|  Print This Post

Print This Post

Print This Post

Print This Post

Print This Post

Print This Post