Posted on Friday, 4th April 2025 by Dennis Damp

Print This Post

Print This Post

Please forward this to others that may find this informative.

Sign up to receive our free e-mail newsletter.

I wrote a version of this article in April 2022, and with the market sell-off, it’s a good time to revisit this subject. It’s impossible to time the market. One of the financial advisers I talked with years ago asked me this question: “Who are you investing for?” He suggested being more aggressive when investing for our heirs, as the market tends to increase over time. I respectfully disagreed with him. I don’t want to see what I worked a lifetime to accumulate decrease in value dramatically.

THE S&P 500 INDEX

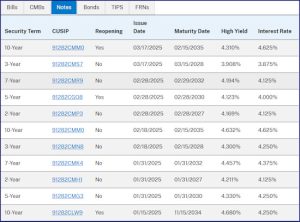

The S&P 500 index has returned a historic annualized average return of just over 10% from 1957 through 2024. THRIFT Plan participants who held the C fund from its inception did very well, to put it mildly. Yet, retirees must weigh the risk associated with continuing an aggressive investment strategy in retirement.

Over the past 123 years, numerous recessions have occurred, including the Great Depression, which began in 1929. From the early 1900s onward, there were four significant recessions, with the longest recovery period spanning from 1929 to 1955, a duration of 26 years.

The average recovery period was 16.5 years! The shortest recovery period lasted only six years, from 2009 to 2015. What most have experienced since 1985 is a bull market interrupted by one recession, which lasted six years. Is another recession imminent? Only time will tell.

S&P 500 Index – 90 Year Historical Chart

Inflation Adjusted / Recessions Highlighted in Gray

The chart above illustrates the time it took the S&P Index to recover to its former levels.

MARKET CORRECTIONS & RECESSIONS

With a market sell off like this, many see their retirement nest egg decrease dramatically and panic. It’s purely psychological. We’re elated when markets rise and depressed during downturns. It takes a steadfast disposition to stay the course and ignore severe market fluctuations, regardless of your age.

It makes sense for many retirees to protect what they’ve worked a lifetime accumulating. I’d rather have one in the hand than two in the bush, my former boss related this sage advice when I was contemplating his job offer.

Market corrections are inevitable after extended periods of excesses. Our national debt now exceeds the country’s GDP. Considering the proposed Federal Reserve interest rate cuts this year, potential tariff impacts, continued inflation, and world unrest, how much will it take to tip the scales one way or the other?

I’m not a clairvoyant or an alarmist; I’m just a casual observer and a seasoned conservative investor.

RISK LEVELS

This current market unrest should encourage retirees and those nearing retirement to reassess their risk tolerance and review their investment portfolios. Federal annuitants often have multiple income sources to rely on, which affords them more latitude with their investments.

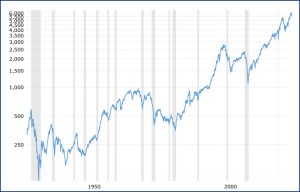

According to Charles Schwab, “The conservative allocation is composed of 15% large-cap stocks, 5% international stocks, 50% bonds, and 30% cash investments. The moderately conservative allocation is 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds, and 10% cash investments. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds and 5% cash investments.”

Personally, at my age, I’m content with a moderately conservative to conservative allocation of mutual funds, ETFs, individual dividend-paying stocks, and a mix of bonds and cash equivalents. I consider I-Bonds, short-term Treasuries, and CDs to be cash equivalents and rely on them more than traditional bonds and bond funds.

Conservative portfolios typically aim to provide both capital appreciation and income for investors. Could I miss out if the economy improves and the market powers ahead? Certainly, but that is a tenable outcome that I can easily live with and is preferable to experiencing a dramatic decrease during an extended recession.

All portfolios that include stocks, mutual funds, ETFs, and bonds will be impacted by market volatility. The more conservative the mix, the less downside risk.

THRIFT PLAN & OTHER INVESTMENTS

THRIFT plan participants can mirror these allocations with existing funds. The TSP offers a mutual fund window that allows us to purchase a variety of mutual funds, including one-decision and balanced funds. The L Income Fund allocations are between moderately conservative and conservative portfolios listed above, with an annual return of 4.9% as of March 2025. The 10-year average return is 4.3%.

The Vanguard Wellesley Income Fund (VWINX) has a moderately conservative allocation and achieved a total return of 5.92% in 2024, with a 15-year average total return of 6.52%. The target allocation is two-thirds bonds and one-third stocks. It has a 4-star Gold Morningstar rating, and its management fee is only 0.23%.

They focus on value dividend-paying stocks and investment-grade bonds. VWINX aims to deliver long-term income growth and a high, sustainable level of current income alongside moderate long-term capital appreciation. This fund fully recovered within less than one year during the 2008-2015 recession.

Another conservative balanced fund is Vanguard’s Wellington Fund (VWELX). It invests approximately two-thirds in growth stocks and one-third in fixed income securities, including bonds. It has a moderate allocation and achieved a total return of 14.76% in 2025, with a 15-year average total return of 8.73%. This 5-Star (GOLD) Morningstar-rated fund’s management fee is only 0.25%. VWELX has been in operation since 1929 and aims to deliver long-term capital appreciation and a reasonable current income. It dropped 22% during the 2008 recession and recovered eighteen months later to its previous high. It took the S&P Index 6 years to recover.

Conservative Portfolios

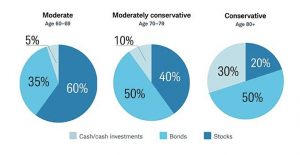

With conservative portfolios, the challenge is to find a decent rate of return on fixed-income investments. Treasury Bills and notes continue to provide decent returns. The balanced funds mentioned above manage their equities and bond investments to maximize yield and capital gains. They are professional money managers; their past performance is a measure of their effectiveness over the years. There are many one-decision conservative funds; it takes research and time to find the one that is right for you.

Professionally managed bond funds are also available, such as the Dodge & Cox Income Fund (DODIX) and Fidelity’s (FTBFX), both of which have a Morningstar Gold rating. However, if interest rates increase, bond funds generally move in the opposite direction; the shorter the duration of the bond fund, the less downside risk it incurs. Individual bonds held to maturity don’t have the market risk that bond funds have.

If you purchase a Treasury, corporate, or municipal bond of any duration and don’t sell it on the secondary market before maturity, you will receive the principal and all interest due. You can purchase individual bonds and Treasuries through your broker or buy Treasuries directly through TreasuryDirect.gov. Investment-grade bonds carry minimal market risk. The TSP G Fund is one of the few bond funds I’m aware of that is guaranteed not to decrease in value. It yielded 4.47% last year, with a 10-year average yield of 4.65%.

I-Bonds are now paying 3.11%, including a 1.2% fixed rate, and those issued in 1999 pay over 5%. Even EE Savings bonds offer a 3% yield if you hold them for at least 20 years. Currently, short-term treasuries are paying more than most bank savings accounts.

CONCLUSION

Conservative portfolios typically aim to provide both capital appreciation and income for investors. Could I miss out if the market powers ahead? Certainly, but that is a tenable outcome that I can easily live with, and it is preferable to experiencing a dramatic decrease in portfolio value during an extended recession.

All portfolios are impacted by market volatility and the more conservative the mix, the less downside risk. Downturns like this can reverse on a dime as issues are resolved, this may not be the time to panic. Here are several articles that may help you reevaluate your personal situation and sleep better at night during times like this:

- Is the Stock Market Keeping You Up at Night?

- How to Keep What You Worked a Lifetime Accumulating

- Have You Considered Hiring a Financial Advisor

The information contained herein should not be considered investment advice and may not be suitable for your situation.

Helpful Retirement Planning Tools

Federal employees and recent retirees with security clearances can

search thousands of high-paying defense and government contractor jobs.

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2025 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: Conservative Portfolio, Market Correction, Market Downturn, Recession, S&P 500, Sensible Investing

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post