Posted on Friday, 3rd September 2021 by Dennis Damp

Print This Post

Print This Post

Updated 12/15/2024

When can I retire? A question asked often by those approaching retirement age and by those early in their career who have the foresight to think ahead. It isn’t as simple a decision as reaching your eligibility date, especially if you haven’t prepared early in your career to have the assets necessary to make this transition. These 7-steps will help you determine when you can realistically retire.

1) Retirement Eligibility

For FERS employees, those hired starting January 1 of 1987 to the present, FERS eligibility is determined by your age and number of years of creditable service. In some cases, you must reach a prescribed Minimum Retirement Age (MRA) to receive civil service retirement benefits. If you leave federal service before you reach full retirement age and have a minimum of 5 years FERS service you can elect to take a deferred retirement. Basically, those with 30 years of service and reach their MRA, anyone who has 20 years at age 60, or as little as 5 years of federal service at age 62 can retire immediately.

CSRS eligibility is based on your age and the number of years of creditable service. Those with 30 years of service at age 55 and anyone who has 20 years at age 60, or as little as 5 years of federal service at age 62 can retire immediately. If you are CSRS Offset, the regular CSRS rules described in the CSRS Eligibility Section apply to you.

A special 20-year retirement system is available for certain designated positions under both retirement systems. This system allows employees to retire sooner, with just 20 years of service. This early retirement system is offered for those who work in air traffic control, law enforcement, fire fighters, and nuclear weapons couriers.

There are special eligibility requirements for certain conditions under both systems for early optional, discontinued service, and disability.

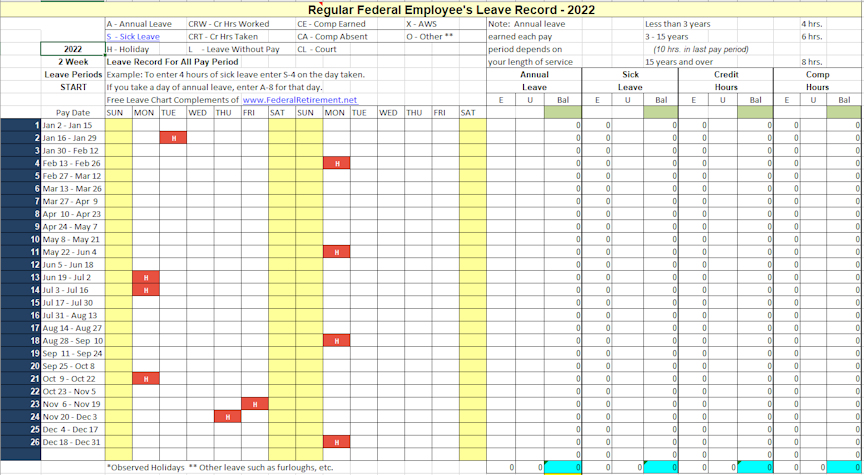

Download our FREE Excel 2025 Federal Employee’s Leave Record

Set Target Retirement Dates & Track Annual, Sick, Comp, and Credit Hours

2) Annuity / THRIFT Income

The annuity calculation is different for CSRS and FERS. The FERS retirement annuity is based on your length of service (which includes unused sick leave if you retire on an immediate annuity) and “high-3” average pay. The high-3 average pay includes locality pay and annual premiums for standby duty and availability if applicable. Other pay such as differentials, overtime, allowances and others are not included. The annuity is 1% of your high-3 average pay times years of creditable service. If you retire at age 62 or later with at least 20 years of service, a factor of 1.1% is used rather than 1%.

The CSRS annuity is based on your length of civil service (which includes unused sick leave if you retire on an immediate annuity) and “high-3” average pay. The high-3 average pay includes locality pay and annual premiums for standby duty and availability if applicable. Other pay such as differentials, overtime, allowances and others are not included. Your yearly basic annuity is computed by adding:

- 1 1/2 percent of your “high-3” average pay times service up to 5 years;

- 1 3/4 percent of your “high-3” pay times years of service over 5 and up to 10; and

- 2 percent of your “high-3” pay times years of service over 10.

Once you establish several tentative retirement dates, request annuity estimates from your HR department.

The TSP 401K savings plan is another lucrative benefit that most take advantage of, especially when you consider that FERS employees receive a 5% match. I only know of one person that I worked with that didn’t participate in the TSP plan. Your contributions while working are tax deferred and the maximum TSP contribution for 2025 is $23,500. If you are over age 50 an additional $7,500 catch up contributions are allowed.

There are a number of withdrawal options and you can annuitize your savings for a guaranteed monthly payment if desired. Your annual TSP annual statement provides an annuity estimate plus a summary of the plan’s previous year’s performance. Many federal employees that retire with 25 to 30 years of service can retire with a million in their accounts and more if they maximize their contributions early in their career.

Federal employees who are retiring soon and recent retirees with security clearances

can search thousands of high-paying defense and government contractor jobs.

3) Social Security

There is much to consider before signing up for Social Security. By waiting until full retirement age or to age 70 your monthly check will increase dramatically, often times doubling from what you would have collected at age 62. For married couples, it’s important to plan who takes Social Security first to maximize benefits long term and for estate planning purposes. FERS employees that retire before age 62 may be eligible for a Social Security Supplement check. I wrote a series of articles on this subject that you will find helpful:

- When Will You Sign Up for Social Security?

- Should I Defer Social Security Until Age 70?

- FERS Social Security Eligibility and Supplement

4) Pre & Post Retirement Living Expenses

Just because you are eligible and wish to retire doesn’t mean you will have the income/resources needed to live comfortably or to maintain a desired retirement lifestyle. Some have medical conditions and/or other expenses that prevent them from retiring until they get on a more solid foundation.

Use our budget work sheet to evaluate your family’s pre and post retirement total income and expenses. This work sheet identifies common expenses that can be shared when both partners have assets and/or are working to equitably support the household. It will also help younger married couples or those living together determine their total combined income and expenses.

We also have an extensive Retirement Cost Analysis section on our website with a free downloadable spreadsheet, specifically designed for federal retirement. It evaluates pre and post retirement expenses and income including a column for the survivor. A sample completed spreadsheet is posted on the site for your review. I developed this spreadsheet when I retired.

5) Other Consideration

Planning together makes sense and if one takes charge of the planning process it’s important to review the plan and obtain suggestions and recommended changes from your significant other. There are many factors to consider such as which benefits to carry into retirement, when to sign up for Social Security and Medicare, the impact of Medicare Part B premiums if you elect to sign up for Part B, and so much more. Medicare Part B premiums are income adjusted and can impact your planning. Here are links to several Medicare articles that you will find informative:

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- A Marriage of Convenience – Medicare & FEHB

- What to Consider Before Enrolling in Medicare B (Part 2)

- Changing to a Lower Cost FEHB Plan When Signing Up for Medicare (Part 3)

- How to Delay Part B Premiums

6) Best Date to retire

The end of the month works best for FERS employees in many cases. Under the FERS system your retirement begins on the first day of the following month. This is also allowed for non-voluntary CSRS retirements.

For the most part, voluntary CSRS retirements are best the first three days of the month and your annuity will start on the next day. If you retire on the 3rd of the month, you will get paid through the 3rd and your annuity will start on the following day. Your first annuity check will be for a partial month, less the three days you worked. However, if you choose to leave on the 4th or later your annuity won’t start until the first of the following month.

There are other considerations such as adding accumulated sick leave and annual leave buy back. Use the following links for more detailed guidance on this subject. One of the links is to Tammy Flanagan’s annual “Best Date to Retire” article. I consider her article the ultimate resource for this subject.

7) Making the Numbers Work

After the first review you may need to fine tune your analysis before taking the leap and sending in your retirement paperwork. This isn’t unusual; a detailed review will uncover assets and benefits you simply overlooked. There are options to consider that can make the transition from workplace to retirement feasible such as: deferring retirement to a later date, possibly working part time, review and eliminate unnecessary expenses, or moving to a lower cost of living area.

It’s never too early to start your planning. When I left military service, I chose working for the FAA rather than in the same job I had in the military with the airline industry. The private sector job initially paid more. I mentioned to my wife that if I stayed in government, I could retire with 35 years of service at age 55 and my military time would count towards retirement. That was a major deciding factor for me at a very young age.

Take your time and evaluate your personal situation to make the best decision for you and your loved ones.

Helpful Retirement Planning Tools

- The Ultimate Retirement Planning Guide

- TSP Guidance

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity.

You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, EMPLOYMENT OPTIONS, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post