Posted on Saturday, 12th January 2019 by Dennis Damp

Print This Post

Print This Post

OPM issued a FACT SHEET covering the impact on federal employee benefits and pay as a result of the government shutdown. The following excerpt explains the impact on employee’s pay and benefits.

FACT SHEET: Pay and Benefits Information for Employees Affected by the Lapse in Appropriations

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

This information covers pay and benefits matters that may be important to employees if the lapse in appropriations continues past payroll processing deadlines. Payroll deadlines vary from agency to agency, so the actual timing of when an employee’s pay and benefits may be impacted will vary.

This information is only for employees who are:

- Furloughed (a type of nonpay status), or

- “Excepted” from furlough (i.e., continuing to work and earn pay, but their pay is delayed until appropriations are authorized).

Employees who are “exempt” from the lapse in appropriations (e.g., because they are not paid from annually appropriated funds) are not impacted.

What you should know

PAY

Furloughed employees: You cannot receive pay during a lapse in appropriations if you are furloughed, and Congress will determine whether you will receive retroactive pay for furlough hours.

Excepted employees: You are entitled to be paid for hours worked, but you cannot receive pay until funding is provided.

ANNUAL AND SICK LEAVE ACCRUAL

Any leave you had previously scheduled during the lapse period is cancelled, so you won’t be charged leave. In addition, per OPM guidance, if you had properly scheduled “use-or-lose” annual leave that you weren’t able to use because of the lapse in appropriations, that leave must be restored to you. Your agency will provide instructions on any action you may need to take.

Furloughed employees: You won’t accrue annual and sick leave during the furlough once you’ve been in a nonpay status for 80 hours (for full-time employees with a regular 80-hour biweekly tour of duty). Congress may, however, authorize retroactive accrual of leave.

Excepted employees: You will continue to accrue leave, but accrued leave will not be available for use until funding is provided.

RETIREMENT

No retirement deductions will be made if you aren’t receiving pay. Generally, a period of nonpay status will have no effect on an employee’s retirement-creditable service or high-3 average pay unless the nonpay status is for more than 6 months during the calendar year.

ALLOTMENTS FROM PAY

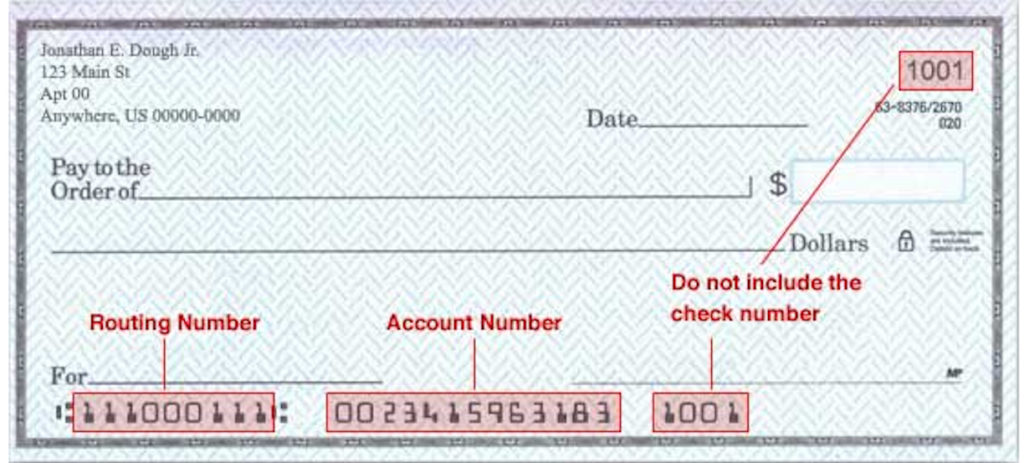

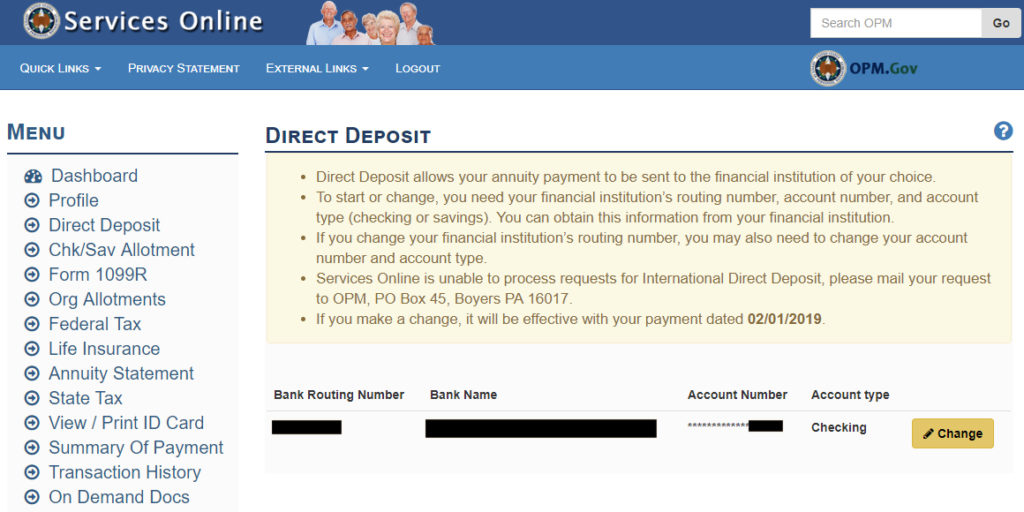

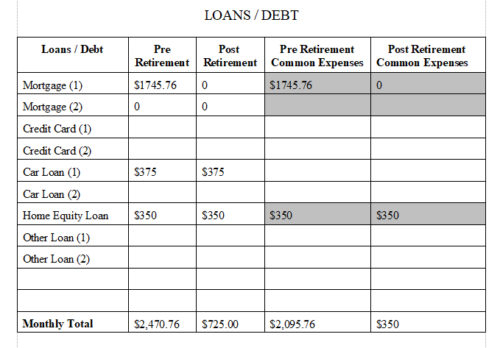

Since no allotments can be made if you’re not receiving pay, you may want to review your allotments to determine whether you’ll need to make alternative arrangements (e.g., if you are using allotments to pay loans, alimony, etc.).

UNEMPLOYMENT COMPENSATION

Furloughed employees are eligible to apply for unemployment benefits, but excepted employees working on a full-time basis are generally not eligible. Employees who wish to file should do so with the Unemployment Office for the state where the employee worked (i.e., last official duty station prior to furlough).

Please be advised, however, if Congress authorizes retroactive pay for furloughed employees, you would be required to pay back any unemployment benefits you received, in accordance with State law. For more information see OPM’s Pay-Leave Guidance and the U.S. Department of Labor’s Unemployment Compensation for Federal Employees website, https://oui.doleta.gov/unemploy/unemcomp.asp.

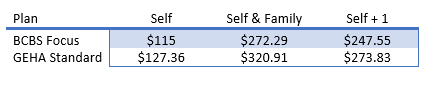

FEDERAL EMPLOYEES HEALTH BENEFITS (FEHB)

FEHB coverage continues even if you don’t receive a paycheck. Your share of premiums will accumulate and be withheld later when the lapse ends and employees can be paid.

FLEXIBLE SPENDING ACCOUNT (FSAFEDS)

Your FSAFEDS payroll deductions stop when you don’t receive pay. You remain enrolled in FSAFEDS, but you can’t be reimbursed for eligible health care claims until you return to pay status and your payroll deductions can be made. Payroll deductions will be subsequently collected to match your annual election amount.

Eligible dependent care expenses incurred during the lapse in appropriations may be reimbursed up to whatever balance is in your dependent care account—as long as the expense incurred allows you (or your spouse, if married) to work, look for work, or attend school full-time.

FEDERAL LONG TERM CARE INSURANCE PROGRAM (FLTCIP)

Your coverage will continue. However, if you usually pay your premiums through payroll deduction, and the lapse period is less than three consecutive pay periods, your accumulated premiums will be withheld when the lapse ends and employees can be paid. Otherwise, Long Term Care Partners will begin to bill you directly for premium payments. You must pay those bills on a timely basis in order to continue your coverage.

FEDERAL EMPLOYEES’ GROUP LIFE INSURANCE (FEGLI)

Coverage continues for up to 12 consecutive months of nonpay status, but premiums are collected only for pay periods for which you receive pay.

FEDERAL EMPLOYEES DENTAL AND VISION INSURANCE PROGRAM (FEDVIP)

Your coverage will continue. However, if the lapse period is less than two consecutive pay periods, your premiums will accumulate and be withheld later when the lapse ends. If you do not receive pay for two consecutive pay periods, BENEFEDS will begin to bill you directly for premium payments. You must pay those bills on a timely basis in order to continue your coverage.

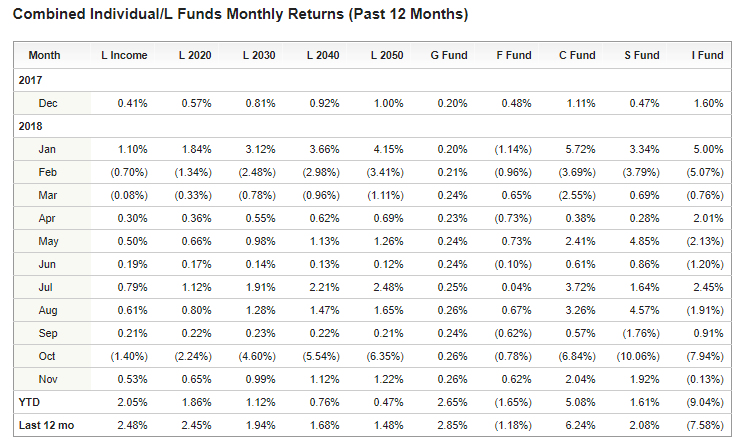

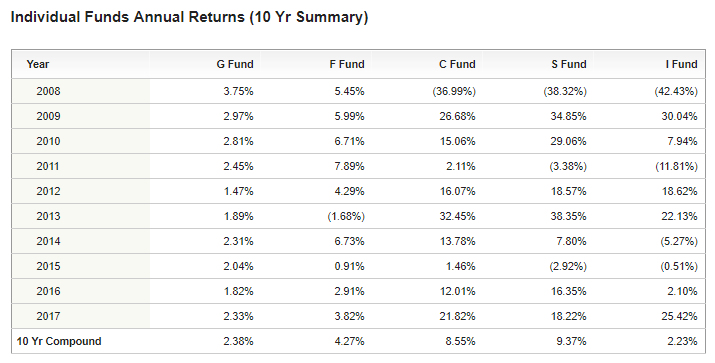

THRIFT SAVINGS PLAN (TSP)

For information on the effect of a furlough on your Thrift Savings Plan contributions, loans, and investments, please refer to https://www.tsp.gov/index.html.

CHILDCARE SUBSIDY PROGRAM

Employees enrolled in their agency child care subsidy program should contact their agency HR office for information about payments.

EMPLOYEE ASSISTANCE PROGRAMS

Employee Assistance Program (EAP) services can be helpful in providing confidential counseling with experienced, licensed counselors, and many EAPs can provide access to legal and financial consultation services. Contact your agency’s EAP office to determine what services might be available to you.

OTHER CONSIDERATIONS

Some mortgage, loan, credit and utility providers have indicated that customers may qualify for alternative arrangements. Please contact your providers for more information.

Note: This guidance should not be considered time and attendance instructions. Guidance on documenting time and attendance will be provided by each agency and payroll provider.’

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

- Retirement Planning Guide TSP Information

- Financial Planning Guide

- How to be Financially Prepared When You Retire (Free Report)

- Master Retiree Contact List (Important contact numbers and information)

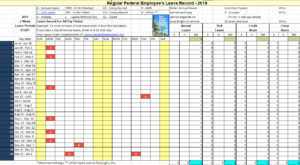

- 2019 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Posted in UNCATEGORIZED

Comments (0)|  Print This Post

Print This Post