Posted on Friday, 12th April 2024 by Dennis Damp

Print This Post

Print This Post

Please forward this to others that may find this information helpful. They can sign-up to receive my free Retirement Planning Newsletter

Our national debt was $15.5 trillion in 2012 when I first addressed this issue, today it has more than doubled and exceeds $34 trillion! Federal budget deficits will continue this year, according to CNBC, as the government borrows over $1 trillion dollars every 100 days.

The National Debt

The national debt consists of public and intragovernmental debt owed by Uncle Sam. Public debt is what the government owes to bond holders including American citizens, international investors, and foreign governments that buy our bonds. U.S. citizens own the majority of the national debt.

Currently, the national debt is just over $34 trillion, it was $32 trillion in 2022 and it reached and has since exceeded 100% of our gross domestic product (GDP). GDP is the value of all finished goods and services made during a specific period within a country. The last time we attained this lofty perch was during WW II and it is unsustainable according to most economists.

I’ll Gladly Pay you Tuesday for a Hamberger Today

Some reading this column may not understand the subtitle for this section, I defer to Wimpy from the Popeye cartoons.

Uncle Sam spent $7.66 trillion last year, their total net cost, according to the Treasury’s 2023 Executive Summary and only took in $4.465 trillion from tax and other unearned income. In other words, approximately 42 cents of every dollar spent was borrowed in 2023. This is a long-term trend and according to the U.S Treasury, it’s unsustainable. Review page 7 of the Treasury’s 2023 Executive Summary Report.

This outrageously high borrowing rate is continuing again this year! It’s insane, and I can’t for the life of me understand why they don’t offset spending shortfalls with realistic cuts across the board, slash obsolete programs, and offset any new programs with cuts elsewhere, like the private sector and all of us have to do.

We all know firsthand just how wasteful government can be, many reading my column worked in the system for decades.

Everyone is impacted by out-of-control spending and neither political party is immune to spending beyond our means.

The State of the Economy

Our economy isn’t in the best of shape though you wouldn’t know it from the stock market highs we’ve seen recently. This is due, in part, to excessive federal spending that appears to be driving the market higher while middle America suffers with out-of-control inflation, especially for the essentials: housing, food and fuel.

Many analysts believe that the market’s recent strength also reflects expectations of a major change in Federal Reserve (Fed) monetary policy. Traders were anticipating multiple interest rate cuts this year that seem to have evaporated recently.

Tech sector growth, seven stocks, attributed to the majority of the market gains in 2023!

Is This Sustainable?

The following chart depicts the scope of the problem and unfortunately the predicament we find ourselves in today. This chart compares the United States’ budget and spending to that of an average American family.

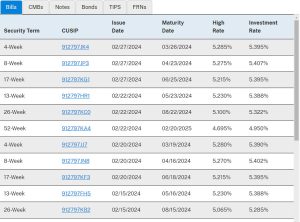

The first table lists government budget statistics for 2023. These figures were obtained from the Treasury’s 2023 Executive Summary.

- United States Tax Revenue: $4,465,600,000,000

- Total Spent: $7,882,800,000,000 (Treasury’s total net costs)

- New Debt: $3,417,200,000,000 (Debt needed to cover expendatures)

- National Debt: $34,600,000,000,000 (Doesn’t include unfunded liabilities)

Now, remove eight (8) zeros and imagine it’s a household budget as noted below. The title for each entry was changed to a related household category:

- Annual family income: $44,656

- Money the family spent: $78,828

- New debt: $34,172 (Borrowed in the Current Year)

- Outstanding debt: $346,000

The $346,000 could include credit cards, home mortgage, and car loans. However, the interest would be prohibitive. For example, consider the average total interest paid on the debt at 7%. Credit card and auto loan interest can be much higher. The yearly interest alone would consume $24,220 or 54% of their annual family income. Totally unsustainable.

The Money Supply

Thankfully or regrettably depending on how you look at it, the Federal Reserve is able to add trillions to our money supply by simply making a book entry which drives inflation higher. They purchase Treasury notes, bills and bonds if the government can’t sell them at auction.

This is somewhat disconcerting on many levels. The government must keep interest rates artificially low in order to service the debt and pay interest to the bond holders. Otherwise, we could default on our obligations and devastate the world economy.

The Impossible Dream

How long could a family continue doing this without going bankrupt and insane to boot? Having unmanageable debt would drive me CRAZY. The government knows this is a problem but continues to ignore the issue.

Imagine having a $100,000 loan and you decide it’s best to borrow more each year to make the payments on your outstanding debt. This simply can’t work.

We may be down but not out! A balanced budget amendment would restore our financial health and ensure future Congressional bodies won’t break the bank.

You frequently hear about ten-year budget reduction plans passed by congress. What they don’t tell you is that after the next election, the new congress is not obligated to continue with those plans and often ignores them completely. If you must balance the budget every year, this wouldn’t be an issue.

Conclusion

Our representatives MUST be fiscally responsible and do what is best for the country instead of focusing on what they need to do to get re-elected. Term limits would allow them to focus on just that, instead of blindly supporting the party line on either side of the aisle.

Many consider elections de facto term limits. If that is the case, why did both parties fast track the twenty second Amendment after President Franklin D. Roosevelt died at the end of World War II?

The 28th amendment states, “No person shall be elected to the office of the President more than twice.” Roosevelt was elected four times as president! Both parties supported it because POWER CORRUPTS when unchecked, and the eight-year precedent set by Washington guards against tyrannical rule.

This is what we are experiencing with our legislatures, too much unchecked power. We need a twenty eighth amendment limiting congressman to six 2-year terms and Senators to two 6-year terms.

In my opinion we don’t have a revenue problem; we have a chronic spending problem!

I wrote several articles that discuss ways to protect what you worked a lifetime to accumulate. You may find these interesting. Some were written several years ago, take that into account when reading them:

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- 2024 Pay Tables

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2024 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center.

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: 2023 Government Spending Analysis, Federal Reserve, National Debt, Out of Control Spending

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION, WELLNESS / HEALTH

Comments (0)|  Print This Post

Print This Post