Posted on Friday, 8th March 2024 by Dennis Damp

Print This Post

Print This Post

Much to my surprise, most banks and credit unions continue to offer paltry yields on their savings and money market accounts. It’s disappointing considering they are using our money to fund customer’s mortgages at 7 percent and higher or new car loans up to the high single digits.

A Little Doesn’t Go a Long Way

Many banks continue to offer .04% to maybe 1% tops on savings and checking accounts. Higher rates are available if you look around or negotiate a better rate with your bank. These low rates would earn you a measly $4 to $100 per $10,000 of savings for the entire year!

Moving that $10,000 to a 5.2% four, eight or 13-week Treasury Bill would earn you $520 over the year! Quit a difference. You can select auto reinvestments with Treasuries for up to two years and auto reinvestments can be canceled at any time if you need the funds. The rates change for each new issue, over the past year the yields have averaged over 5 percent.

It appears that the Federal Reserve intends to hold rates at the current levels for longer than most financial pundits anticipated. With this country’s huge national debt, I’m not sure anyone can predict where inflation and the market will end up if government doesn’t stop their excessive spending and balance the national budget.

Treasury Bill Rates Holding Steady

My article titled “Ditch your Bank’s Low Savings Rates” describes the advantages of Treasury bills compared to bank and credit union rates.

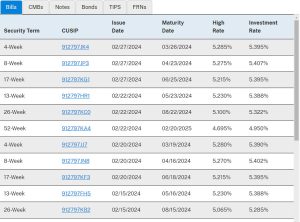

Today you can earn just over 5% on a 4, 8 or to 13-week T-Bill, the 26-week T-Bills are currently paying 5.065%. My last 13-week T-Bill investment yielded 5.368% on February 2, 2024 and my 8-week Bills reinvested at 5.418% on January 1, 2024.

If you invested $25,000 in a 13-week T-Bill issued on 2/1/2024 that is earning 5.368%, the Treasury withdrew $24,665 from your account. On the maturity date of 5/2/2024 they will deposit $25,000 into your account resulting in a $335 profit.

Had you had this amount deposited in a bank savings account paying 1%, you would have earned $62.50!

Treasury Bill Investment Rates

Purchasing Treasury Bills, Notes, and Bonds

Visit TreasuryDirect.gov to register, explore the options, and start purchasing Treasury bills, notes, and bonds, TIPS, and savings bonds. You are buying direct from the government and eliminating the middle man; there aren’t any fees charged for purchases.

Most brokerage accounts offer clients access to Treasury auctions and will purchase them for your account; the longer-term notes and bonds can be sold on the secondary market if needed. Here is more information on the Treasury’s programs:

CDs and Savings Bonds

According to the Federal Deposit Insurance Corporation (FDIC), the national average savings account is only paying 0.47% as of February 2024. A slight increase from my last update on this subject.

Many online banks, credit unions, and some regional banks are offering competitive rates for savings accounts and CDs from 3.5 percent and higher in many cases. Most higher rate CDs in my area are for terms from 6 to 15 months. A good deal compared to just a year ago when most rates were just moving above 1 percent and they are FDIC or NCAU insured.

I was able to lock in 15-month CDs at two local credit unions late last year for 5.75% and my primary credit union matched their offer!

The 30-year average gain of the S&P 500 is 7.1% after inflation. These CDs have no market risk if you stay under their insured limits. I moved some of the funds I was cycling through the Treasury to this attractive yielding investment. In hindsight, I could have moved more.

Currently short-term Treasury T-Bills rates have dropped a bit, but still above 5%. Rates may stay close to the current levels for some time before the Treasury changes course and begins lowering rates.

I-Savings Bond Rates

I Bonds issued November 1, 2023, to April 30, 2024, earn 5.27%. This includes a 1.3% fixed rate. Still a great rate for one of the safest investments available. You can’t cash them in for one year. Plus, if you redeem them within the first five years you lose three months’ interest.

I-bonds issued in 1999 had a 3% fixed rate, they are earning just under 7% now, the 3 percent fixed rate and the 3.97% inflation rate for the new issue I-bonds.

If you purchase an I-Bond by no later than April 31, 2024, you’ll receive the 5.27% for six months from the date of purchase. The rate will change after that to the new inflation rate announced this coming May plus any fixed rate your previously purchased bonds may have.

Market Observations

The stock market is soaring and it reminds me of the dot-com bubble back in 2000. According to Wikipedia, “Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past.” The previous booms and subsequent crashes were related to many of the new technologies of their time, railroads, TVs, computers.

During the dot-com crash, many online shopping companies failed and shut down. Today, the same over exuberance for tech and artificial intelligence (AI) in general appears to be on that same trajectory.

Actually, AI isn’t new, it started shortly after computers were first developed. Today, they are dressing it up, and repackaging it to gain an advantage and drive stock multiples through the roof, and it’s working, just my perspective.

All companies down the road will benefit from these innovations in one way or another. If that is true, why aren’t the 493 other stocks in the S&P benefiting from the AI revolution and the growth in the index isn’t more broadly distributed? Will it take a recession to force the issue?

I’m not a financial analyst, just an observer and there seems to be some correlation to prior booms and subsequent busts. Especially when you consider that the top 7 stocks of the S&P index accounted for 29% of the index’s market value last year!

According to Goldman Sachs’, the Magnificent Seven stocks gained 71% during 2023 while the other 493 stocks in the S&P added just 6%. Overall. This streak has extended into 2024 at a feverous pace. These seven stocks include: Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), Tesla (TSLA), and Nvidia (NVDA).

Technology including AI and IT stocks growth has exploded and many believe this is only the beginning. I’m somewhat skeptical, time will tell if a major correction or recession is on the horizon.

Summary

As a retiree, I prefer to invest in the safety of Treasuries, CDs, and conservative stocks, mutual funds, and market leaders that have been around for many decades, pay dividends, and have sound fundamentals. Many retirees set aside a small portion of their investments for the more aggressive growth stocks, mutual funds and ETFs of the day.

Now that CD rates are improving; if you can lock up your discretionary savings and investments for 6 to 15 months or longer, they are a viable option. CDs can be cashed in before maturity, however the penalties can be significant. Treasury Bill rates are moderating down a bit, not much but you can see the trend on the above chart.

Short term T-Bills continue to provide impressive yields considering how many banks continue to low ball their savings rates for established accounts. These banks are betting on the reluctance of many to move funds from their savings and checking accounts elsewhere.

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- 2024 Pay Tables

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2024 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center.

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: CDs, Fixed Income Update, Higher CD Rates, I Bonds, Retirement Savings, T-Bills

Posted in ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post