Posted on Thursday, 17th November 2022 by Dennis Damp

Print This Post

Print This Post

Please forward this article to others that may find this information useful.

This summary compares the 2023 Self + One Blue Cross Blue Shield (BCBS) Basic plan to the GEHA Standard plan for those who are 65 or older. BCBS has the most subscribers and GEHA has one of the lowest premiums for their standard plan.

Many annuitants change to a lower cost FEHB plan when they sign up for Medicare A and B because most plans waive the majority of the deductibles, copayments, and coinsurance when Medicare becomes your primary insurer. Medicare pays first and then your FEHB plan pays a portion if not all of the remaining bill for you.

Medicare Supplement Plan Caution

This time of the year, those 65 or older receive many offers from private insurers for Medicare Supplement Plans. When you sign up for a private insurer’s Medicare Supplement Plan your only option is to cancel your FEHB plan, you can’t suspend coverage. These plans are not the same as Medicare Advantage (MA) Plans.

The private sector Medicare Supplement Plan brokers don’t understand the FEHB program and may sell you a product that doesn’t provide the comprehensive coverage you now have. If you are contemplating this move, read the following article first:

Costs

When enrolled in Medicare you can go to any provider that accepts Medicare, most do. Some plans, like BCBS Standard, don’t waive deductibles, copayments, and coinsurance fees for out of network providers; that can be expensive. Check Section 9 of your FEHB plan brochure to verify coverage.

Medicare Premiums

Medicare Part B Premiums add to your monthly healthcare costs which for 2023 will be $164.90 to as high as $560.50 due to Medicare’s Part B income adjusted premiums. The good news is that Medicare Part B premiums for 2023 actually decreased by 3% after a 15% increase the year before.

To qualify for the lowest Part B premium in 2023, individuals must have a Modified Adjusted Gross Income (MAGI) of $97,000 or less and married couples $194,000 or less.

MAGI is calculated by adding back certain deductions such as tax-free municipal bond and student loan interest, tuition, rental loss and IRA contributions to your IRS adjusted gross income.

FEHB Premiums

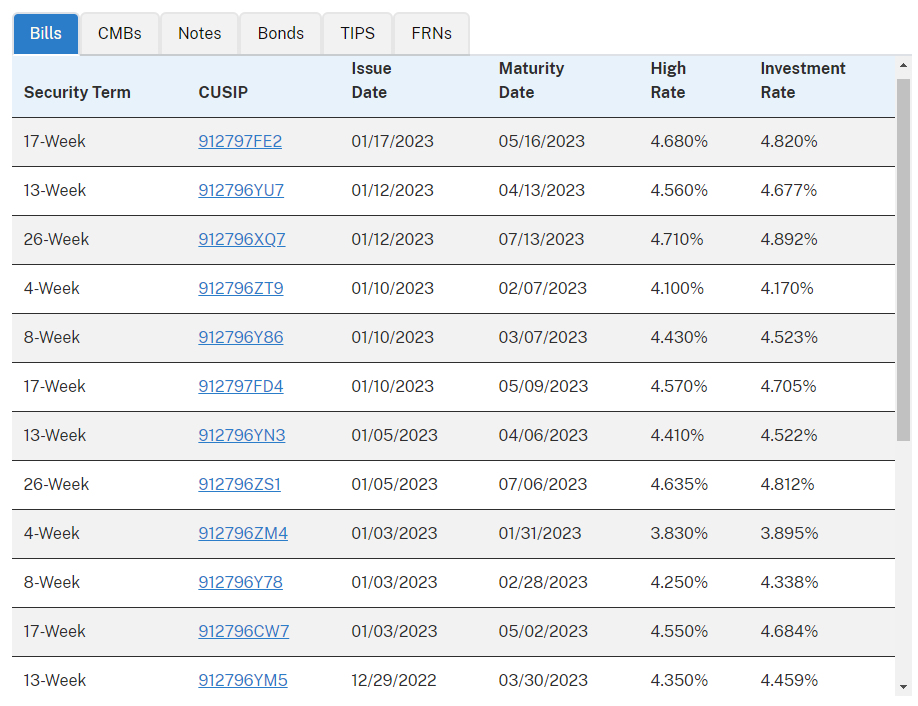

The 2023 BCBS Basic premium of $472.12 increased $47.17 while the GEHA Standard premium of $320.39 increased $28.47 year over year.

Combined FEHB and Medicare Premiums

Both Self-Plus-One members enrolled in Medicare A and B have to pay a Medicare premium of at least $164.90 per month for a combined total of $329.80 as noted in the following calculations.

Your monthly health insurance cost would be as follows, assuming both are enrolled in Medicare Parts A & B and the couple is earning $194,000 or less a year:

- BCBS Basic – $472.12 + $329.80 = $802.01 monthly, $9,624.12 / year)

- GEHA Standard – $320.39 + $329.80 = $650.19 monthly, $7,802.28/ year)

The above totals do not include any FEDVIP coverage for dental and vision care.

Medicare Part B Reimbursement

BCBS Basic members apply for and each receive a $800 Medicare Reimbursement for a Self Plus One enrollment, the adjusted annual costs would be reduced to $8,024.12/year in the above example. That’s $1600 a year for a Self-Plus-One enrollment when both have Medicare A & B.

To obtain the reimbursement you must provide proof that you paid Medicare premiums in 2023 by submitting a Medicare Reimbursement claim. Claims are submitted online by registering for a Medicare Reimbursement Account at fepblue.org/mra or through the EZ Receipts app. You can also mail or fax in a claim form. GEHA provides a $1000 per member reimbursement only for their high option plan.

Lower Cost Medicare Advantage Plans

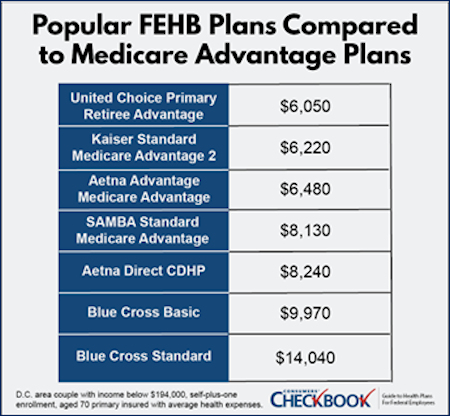

Another low-cost option is to consider a FEHB sponsored Medicare Advantage (MA) plans issued through Aetna, Kaiser, and UnitedHealthcare. Some of these plans pay almost the entire Medicare Part B premium for you and waive all doctor and hospital expenses.

They often have the lowest estimated yearly cost for retirees. In order to join one of the new MA plans, retirees must enroll in the sponsoring FEHB plan, be signed up for both Medicare Parts A and B, and then sign up for that FEHB provider’s MA plan.

These plans are worth considering, however there may be coverage and provider availability issues that you should be aware of before signing up.

2023 Brochures

Review section 2 of the plan brochure for a complete list of changes.

Prescription Drugs

If a drug you take isn’t on your plan’s formulary list, they will recommend covered alternatives. I ran into this with Asmanex, an asthma drug. They offered several substitutes; I’ve been using Qvar without incident.

The BCBS Basic Option uses a managed formulary for certain drug classes. They have a 5-Tier system, Tier-1 for generics up to specialty drugs at higher tier levels. Copays range from $15 at Tier-1 one up to $110 for Tier-5 drugs. If you purchase a drug in a class included in the managed formulary, that is not on the managed formulary, members must pay the full cost of that drug since that drug is not covered under your benefit.

- Use their “Prescription Drug Cost Tool” search function to determine if your drugs are covered, their availability, and how much they cost.

GEHA Standard option uses a formulary drug list that excludes coverage for certain medications unless they determine they are medically necessary. You pay a $10 copay for a 30-day generic supply, 50% up to $200 for a retail preferred brand name, and 50% up to $300 for a retail preferred brand name.

- Use their “Check Your Drug Cost Tool” search function to determine if your drugs are covered, if available at your local pharmacy, and how much they cost.

Both plans offer 30 to 90-day local pharmacy pickup or mail order delivery options.

Catastrophic (Out-of-Pocket) Expenses

Both plans limit your annual out-of-pocket expenses for covered services to $13,000 each contract year. BCBS Basic members would be responsible for the entire amount billed when using out-of-network services. GEHA members limit out-of-pocket expenses for out-of-network services to $17,000 per contract year.

Observation

Many federal annuitants are hesitant to sign up for Medicare Part B due to the additional cost and what appears to be duplicate coverage. I personally know a number of retirees that are paying large copayments and coinsurance fees because they didn’t sign up for Medicare Part B at age 65.

If you review your plan’s deductible, coinsurance and copayments, the costs could be prohibitive for those without Medicare Part A & B coverage.

For example, in the GEHA 2023 Standard Plan, those who don’t have Part B would pay a $20 copayment for physician visits; a $35 copayment to see a specialist for covered office visits and 15% of other covered professional services including X-ray and lab. If the service is provided by a non-PPO, the member has to pay 35% of covered professional services. With Part B these fees are waived.

BCBS Basic Plan members without Part B would pay a $30 copayment for in-network primary care physician visits; $40 to see a specialist for covered office visits and up to $200 in diagnostic services. All costs would be the member’s responsibility if out-of-network providers are used. There are other copayments listed in the brochures for both plans.

Plan Comparison Tools

OPM’s Plan Comparison Tool includes much of the information you would need to make an informed decision with some limitations. The Consumers’ Checkbook 2022 Guide to Health Plans does all of the complex costing calculations for you online and provides side-by-side evaluations with ratings for each plan.

For retirees, Checkbook’s Guide provides a yearly cost estimate for every FEHB plan with Medicare Part A only and a separate estimate with Medicare parts A and B. This allows users to determine which plans coordinate best with Medicare, the cost reduction of adding Medicare Part B, and whether the FEHB plan offers Medicare Part B premium rebates.

- Importantly, the Checkbook’s Guide reviews FEHB Medicare Advantage plan options which can be less expensive for many retirees.

The Consumers’ Checkbook Guide is available November 14th in print and online formats. Federal Retirement site visitors and newsletter subscribers can order the Consumers’ Checkbook Guide and save 20% by entering promo code FEDRETIRE at checkout. Online access is $13.95, the hard copy version is $16.95, or pay only $20.95 for both online and hard copy, less 20% with promo code.

Summary

My wife and I enrolled in GEHA basic when we applied for Medicare A & B to reduce costs. Both plans waive all deductibles, copayments, and coinsurance for covered services for Medicare enrollees except for prescription drugs. GEHA also covers out-of-network care. Plus, we travel, and require coverage for out-of-network providers.

Prior to signing up for Medicare, we were enrolled in the BCBS Standard plan because they had no annual deductible and the coinsurance and copayments were lower. Even though the BCBS basic plan doesn’t cover out-of-network providers, 96% of hospitals, 95% of doctors and 55,000 retail pharmacies are in their network.

There is more to your selection than meets the eye. Compare benefits and services between carriers. For example, I use hearing aids; GEHA pays up to $2,500 every three years for replacements, BCBS provides the same reimbursement but limits replacement to every 5 years.

Review section five, the Benefits section in the plan brochures to ensure you will receive the services and benefits needed for you and your spouse. Take your time this open season to thoroughly review your options and costs.

Helpful Retirement Planning Tools

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: Dental & Vision Plan Selection, FEHB, FEHB Open Season, Health Care Plan Comparisons

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, WELLNESS / HEALTH

Comments (0)|  Print This Post

Print This Post

Print This Post

Print This Post

Print This Post

Print This Post