Posted on Friday, 10th November 2023 by Dennis Damp

Print This Post

Print This Post

The Inflation Reduction Act’s Part D reforms will impact FEHB plans in 2024. Historically, most federal annuitants didn’t need to consider Part D because FEHB prescription drug benefits were as good or better and didn’t have an additional premium. However, OPM has allowed FEHB plans to offer Part D prescription drug plans (PDP) in 2024, which means more federal annuitants will benefit from improved coverage.

We’ll walk you through the important changes and annuitants’ two options to receive Part D coverage—PDPs and FEHB Medicare Advantage (MA) plans.

This article is a collaboration between Kevin Moss of Checkbook.org and Dennis Damp, host of www.federalretirement.net. Kevin Moss is a senior editor with Consumers’ Checkbook.

Part D Prescription Drug Plans (PDP)

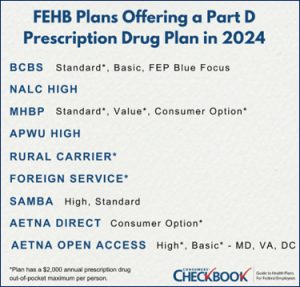

The following 17 FEHB plans will offer a PDP next year:

To receive OPM approval, the PDP must offer prescription drug coverage that’s as good as or better than the FEHB plan.

After our review, we agree with OPM: The PDP benefits are indeed as good or better, and this is especially true for the PDPs highlighted above that have a $2,000 annual prescription drug out-of-pocket maximum.

If you have Medicare Part A or Parts A & B and you’re currently enrolled in one of the 17 FEHB plans above, you’ll be auto-enrolled in the PDP (except for BCBS plans which only auto-enrolls if you have Parts A & B). Your plan will notify you of auto-enrollment and you’ll have 30 days to opt out if you wish. You’ll then receive a new Part D prescription drug insurance card and coverage will commence 1/1/2024.

Most federal annuitants, especially those with moderate to high prescription drug costs, will benefit tremendously from these changes. If you aren’t enrolled in one of the 17 FEHB plans offering a PDP, consider switching to enjoy these improved prescription drug benefits. You’ll need to contact the plan directly to enroll, either through the website or a toll-free number.

There are a few cases where the PDP might not be the best choice for a federal annuitant.

- If you have income above $103,000 as an individual or above $206,000 as a couple, you’ll pay IRMAA for the PDP. Annuitants below the income threshold pay no extra premium. Keep in mind that Part D IRMAA is far less than Part B IRMAA, $12.90/month in the first tier compared to $69.90/month. The benefits of improved prescription drug coverage will outweigh Part D IRMAA for many.

- If you receive drug manufacturer assistance when purchasing a prescription drug, you’ll lose that option with Part D enrollment. Annuitants will need to weigh their current discounted price against the drug price from the PDP, and the additional benefits that the PDP provides.

- Members enrolled in the FEP Medicare Prescription Drug program have no coverage for drugs obtained and/or purchased overseas. Those who travel overseas frequently or go for extended stays may wish to opt-out of the program or consider purchasing travel insurance which often protects against health care expenses not covered by your health plan.

If you decide to unenroll from the PDP, you can rejoin in the future with no late penalty. FEHB prescription drug coverage is considered creditable coverage.

FEHB Medicare Advantage Plans

Medicare Advantage plans package original Medicare, Parts A & B, with Part D prescription drug coverage. For FEHB plans that offer an MA option, you pay the FEHB premium and the applicable Part B premium. Most of the FEHB MA plans have generous Part B premium reimbursements and no additional costs for approved healthcare services from providers that accept Medicare and the plan, besides prescription drugs.

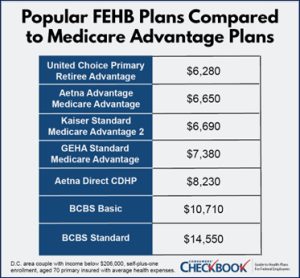

The combination of no out-of-pocket healthcare costs outside of prescription drugs and at least partial Part B premium reimbursement can produce savings. For every FEHB and FEHB MA plan, Checkbook’s Guide to Health Plans for Federal Employees provides a yearly cost estimate, which is a combination of the for-sure expense of premium (both FEHB and Part B in this case) and the likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

A D.C.-area couple with a 70-year-old primary insured with average healthcare expenses, income below $206,000, and self-plus-one enrollment could save $8,270 in likely healthcare expenses next year by switching from BCBS Standard to United Choice Primary Retiree Advantage.

Likely Healthcare Expenses 2024

While an FEHB MA plan will be the least costly plan for most, it may not be the right plan for you.

- Like PDPs, you’ll be subject both Part B and Part D IRMAA if your income is above the threshold ($103,000 for individuals or $206,000 for couples). The savings gained by enrolling in an FEHB MA plan will be eroded by these IRMAA payments, but this could still be the cheapest plan if your income places you into just the first IRMAA tier.

- If you spend a considerable amount of time abroad, only UnitedHealthcare Medicare Advantage plans provide routine overseas care. All FEHB MA plans would cover emergency overseas care.

- Your provider choice may be limited. While the plans state that you can see anyone that accepts Medicare, the provider must accept the plan as well. Make sure to check how any current or future providers will be covered before enrolling in an MA plan. Also, keep in mind that since you must have Medicare Part B to enroll in an MA plan, you could always use your Part B benefit to go outside the MA provider network. You would be subject to the Part B deductible of $240 and would be responsible for 20% of the allowed Medicare charge in that case.

Caution

Don’t confuse the new FEHB MA options with private sector Medicare Supplement and MA plans being sold on TV ads and through the mail. If you decide to enroll in a private sector MA plan, one outside of our FEHB program, you should suspend your FEHB plan. If you cancel your FEHB plan, you can’t return to the FEHB program.

With the FEHB MA offerings you MUST KEEP your FEHB plan; during the next open season, you can change to any of the FEHB plans available in your area if desired. If you sign up for a Medicare Supplement plan you can’t suspend your FEHB plan, you can only cancel your coverage! Read the following article on this subject if you are considering a Medicare Supplement plan:

Are MA Plans Too Good to be True?

How do the MA plans pay you a Part B reimbursement, in some cases a substantial one, and pay the bills? Well, they have to manage their program through improved efficiencies and cost reductions elsewhere. Typically, through the use of their provider networks and prior authorization for many tests and procedures. Nothing is for free, there is an underlining cost that must be paid.

The MA plans are under contract with Medicare to provide what Medicare originally covered. Your providers will send you a new MA plan card to use when you go in for health care services.

Generally, the FEHB sponsored MA plans appear to be a better option than private sector non FEHB sponsored plans. Yet, you still have to look under the hood to ensure the providers you need are in the network and will accept your new plan.

Many MA plans require prior authorization for expensive procedures, surgeries, and tests; providers must be preferred and accept Medicare assignment. This can be frustrating; check with the plan you are interested in to see exactly what hoops you must jump through to get the services you need, when you need it.

One of our newsletter subscribers relayed how she had to go through 6 weeks of therapy before the carrier would approve an MRI and then further delayed the test for other reasons.

Here are links to several recent articles that discuss some of the pitfalls of Medicare Advantage (MA) plans across the country, especially in rural areas:

- Hospitals are dropping Medicare Advantage left and right

- ‘Deny, deny, deny’: By rejecting claims, Medicare Advantage plans threaten rural hospitals and patients, say CEOs

Corrections to the Last Article

In my last article titled The FEP Medicare Prescription Drug Program (MPDP), I confused the funding for the new Part D plans with the MA option. In the article sent out to our subscribers I stated the following:

The FEP Medicare Prescription Drug Program (MPDP) is a prescription drug program with a Medicare contract.

The Final Word

This Open Season will be one of the most important in recent history for annuitants. Improved Part D coverage will help most federal annuitants, but many will need to change plans to receive these benefits.

PDPs provide better prescription drug coverage for all FEHB plans that offer one, especially for the plans that offer the $2,000 annual maximum for prescription drug expenses.

FEHB MA plans can offer an even greater way to save, not just on prescription drugs but on all healthcare expenses. There are more FEHB MA plans to choose from for plan year 2024.

Prescription drug coverage under the PDP and MA plans can reduce your costs significantly. My wife was prescribed Jardiance recently and the cost under my GEHA Standard Plan for a 90 day supply was $500. Under their GEHA Standard MA plan that same drug costs $80! Quit a savings; we were able to get a significant discount through the manufacturer for as little as $10 per month.

I highly recommend Checkbook’s 2024 Guide; their online plan comparison tool provides all of the information you will need to make an informed decision on what plan is best for you.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2024 Guide to Health Plans for Federal Employees will be available on the first day of Open Season, November 13th. Check here to see if your agency provides free access. The Guide is also available for purchase and Federal Retirement readers can save 20% by entering promo code FEDRETIRE at checkout.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- Annuity Expectations – Before and After

- TSP Guide

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: MA Plan Questions, MA Plans, Medicare, Medicare Advantage Plans, MPDP, Prescription Drug Plans, Social Security

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post